Nondiscrimination Testing: Minimum Coverage Test

The minimum coverage test is one of several nondiscrimination tests a plan must satisfy in order to remain compliant with IRS rules. There are two versions of the test: the ratio percentage test and the average benefits test. Both include enough variables and exceptions that this article could get really long if we went into all those details. Instead, this article is intended to provide a general overview of the ratio percentage test.

What Is the Purpose?

The purpose of the test is to make sure a given plan covers enough non-highly compensated employees. That sounds straightforward enough, but some of those terms are loaded.

How Much Is “Enough”?

We will get into more detail below, but the magic number to keep in mind when it comes to the minimum coverage test is 70%.

What Is a Plan?

Each contribution type is considered a separate “plan." In other words, if a plan offers 401(k) deferrals, a company match, and company profit sharing contributions, the minimum coverage test must be applied three times — once for each type of contribution. This is to ensure a plan is not designed to cover everyone in the employee-funded 401(k) portion while covering only the owners and officers in the company-funded profit sharing contribution.

How Does the Test Work?

The first step is to identify which employees must be considered. This generally includes not only the employees of the company sponsoring the plan but also the employees of any companies that are related to the plan sponsor (See our FAQs on controlled groups and affiliated service groups).

Step two is to apply the plan’s eligibility requirements. So, if a plan requires an employee to be at least age 21 and complete one year of service to join the plan, anyone not meeting those criteria is set aside for purposes of the test. We will refer to those who are left as the testing group.

Next, we divide the testing group into four subsets:

- Highly compensated employees (HCEs) who benefit,

- HCEs who do not benefit,

- Non-HCEs who benefit, and

- Non-HCEs who do not benefit

It is important to note that any categories of employees who are completely excluded from the plan will fall into the non-benefitting subsets; however, the only ones that impact the test are those who would have otherwise joined the plan if they weren’t specifically excluded.

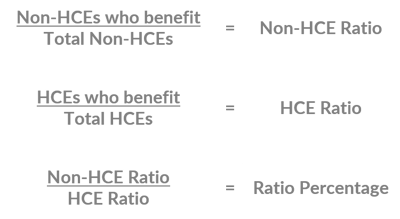

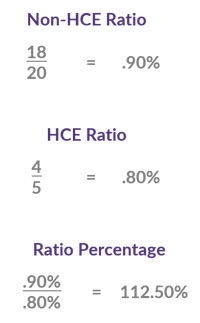

After that, it is a relatively simple calculation:

As long as the ratio percentage for the plan is at least 70% (that magic number we mentioned at the beginning of the article), the plan passes the minimum coverage test.

Let’s look at a quick example.

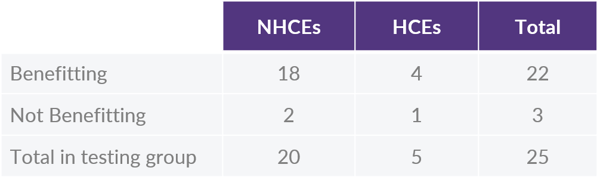

ABC Company has 35 employees, but only 25 have met the age and service requirements. So, those 25 make up the testing group. There are 5 HCEs and 20 non-HCEs.

The plan excludes salespeople, and the testing group includes 3 salespeople, 1 of which is an HCE.

Here is how the testing group breaks down:

Here is the test:

Since the plan's ratio percentage is 70% or greater, this plan passes the minimum coverage test.

What Does This Mean?

For starters, it means that plan sponsors should be aware that normal changes in their workforce might impact testing. If turnover suddenly increases, or there is a growth spurt, it might be a good idea to run some projections to head off any potential testing issues before they arise. Perhaps more importantly, the coverage test can be used as a valuable design tool.

The ratio percentage test focuses on ensuring that at least 70% of the NHCEs benefit, but that means that up to 30% can be excluded. While it is generally a positive to expand plan coverage as much as possible, sometimes business realities are such that it would be cost-effective to exclude certain groups of employees. By working with experts who understand this important test, it may be possible to further maximize the cost-effectiveness of your plan.

Additional information about the minimum coverage test can be found in Internal Revenue Code section 410(b).