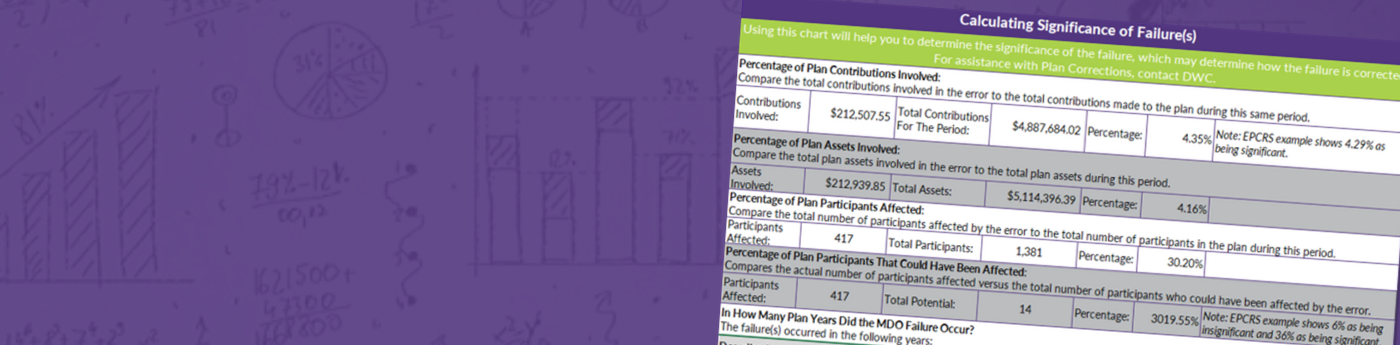

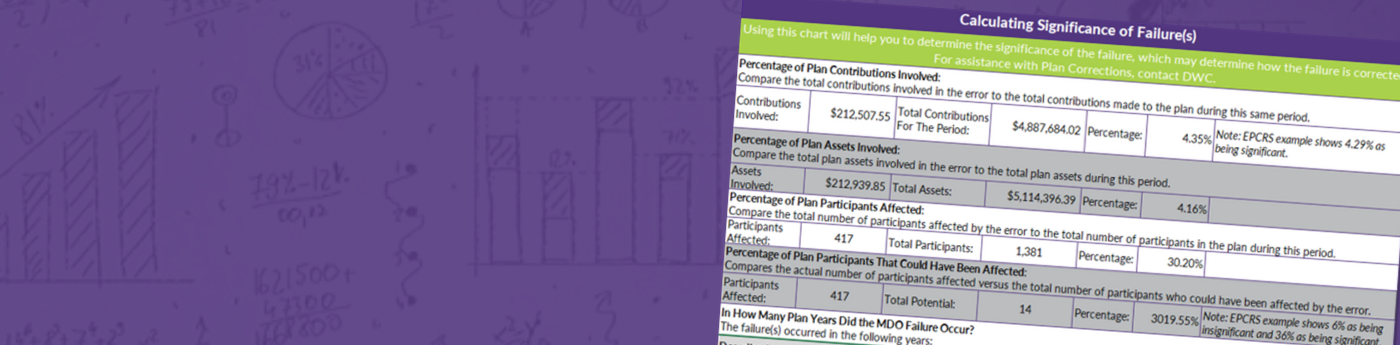

In order to be eligible to correct an operational error under the Employee Plans Compliance Resolution System's ("EPCRS") self-correction program one of the first steps is to determine whether the failure is significant or insignificant.

Good question. The IRS has not given a clear-cut answer, but it has provided a list of factors they consider and we've worked them into a handy calculator.

While significance is always going to be somewhat subjective, you can take some of the guesswork out of it by downloading our calculator today.

© 2017 DWC - The 401(k) Expert P.O. Box 241267, St. Paul, MN 55124