Profit Sharing Allocation Methods

Many retirement plans are designed to include a feature that allows the plan sponsor to make a profit sharing contribution each year. Since IRS rules allow the contribution to be discretionary (whether a contribution is made at all and, if so, the amount) from one year to the next, including a profit sharing feature adds flexibility to the design without backing the plan sponsor into a corner.

In addition to that broad discretion, IRS rules also allow a variety of methods to determine what portion of the total contribution goes to each plan participant. Each of these allocation methods can be combined with 401(k) features, matching contributions, etc. to achieve an overall design customized for each company’s needs.

We will describe several of the more common allocations methods below.

Salary Proportional Method

The salary proportional or pro rata method provides that each participant receives an allocation equal to a uniform percentage of his or her compensation. The contribution may be expressed as a percentage, e.g. 5% of pay to all eligible participants, or as a flat dollar amount.

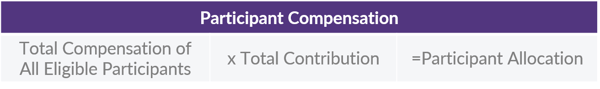

In the case of a flat dollar amount, each participant’s share of the total is determined using the following formula:

Permitted Disparity Method

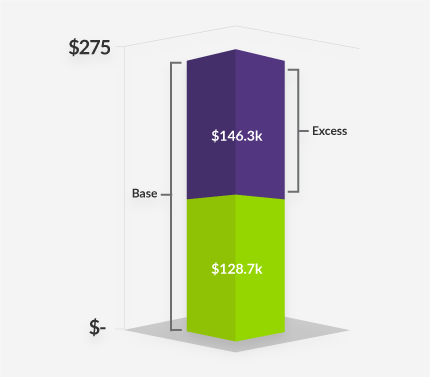

The permitted disparity method, also referred to as Social Security integration, recognizes that Social Security benefits are only provided on an individual's compensation up to the Social Security Wage Base ($118,500 for 2015) and allows additional plan contributions on pay exceeding that level(referred to as Excess Compensation).

The permitted disparity method, also referred to as Social Security integration, recognizes that Social Security benefits are only provided on an individual's compensation up to the Social Security Wage Base ($118,500 for 2015) and allows additional plan contributions on pay exceeding that level(referred to as Excess Compensation).

The contribution is calculated in two steps:

- Step 1. A uniform percentage of total base pay is allocated to all eligible participants. This is referred to as the base percentage.

- Step 2. A uniform percentage of Excess Compensation is allocated to all eligible participants who have such pay. The excess percentage cannot exceed the lesser of the base percentage or 5.7%.

It is possible to integrate the allocation at a level below the Social Security Wage Base; however, doing so often results in a reduction of the maximum excess contribution percentage.

New Comparability Method

The new comparability method of allocating profit sharing contributions, also referred to as cross-testing, uses the time value of money as a basis to allocate larger contributions to participants who are closer to retirement. As illustrated below, if the goal is to fund a similar benefit at retirement, a much larger annual contribution must be made for someone who has only 10 years until retirement than for someone who has 35 years.

.png?width=894&name=DWC-Charts-2%20(1).png)

Depending on the demographic make-up of a company’s work force, the new comparability method can be an effective means of targeting contributions to certain senior personnel such as the owners or officers.

Eligible participants are divided into allocation groups, usually with each participant placed in his or her own group to maximize flexibility. Each year, the company decides the amount to allocate to each group.

NHCEs are generally required to receive a minimum “gateway” contribution that is equal to the lower of the following:

- 5% of compensation, or

- One-third of the highest percentage allocated to any HCE

These contributions are then projected to a benefit at the plan’s normal retirement age and tested to confirm the HCEs do not receive a benefit that is disproportionately higher (as a percentage of pay) than that provided to NHCEs. If HCE benefits fall outside of the acceptable range, the company can choose to increase contributions for NCHEs, reduce contributions for HCEs or a combination of both.

The effectiveness of new comparability is dependent on the demographic composition of a company’s workforce. Any changes from one year to the next can have an impact on whether the plan passes the applicable nondiscrimination tests, so it is critical to discuss any anticipated changes with an experienced professional such as a member of the DWC team.

Changing Methods

The allocation method to be used must be specified in the plan document. That means the only way to change methods is by adopting an amendment to the plan. The general deadline for making such a change is the end of the year for which the contribution will be made; however, there are some additional timing restrictions that may impose an earlier deadline.

If you are considering making a profit sharing contribution and would like to see an illustration of how these allocation methods would work for your company, give us a call, and we would be glad to prepare an illustration for you.