Congratulations on making it through our last installment and to this one. We typically do not like to get that deep into the weeds, but hey, this is actuarial stuff after all, and you can’t always get what you want. To make up for the complexity of determining the Minimum Required Contribution (MRC), we are going to discuss Recommended Contributions, which requires just one simple mathematics exercise – subtraction.

We learned last time that the minimum amount required to be contributed to a cash balance plan will almost always leave the assets below the promised benefits, i.e. the sum of the hypothetical account balances. For example, in the first year of Robert Smith Inc.’s plan, the contribution credit is $100,000 and the MRC is only $80,873. Contributing the minimum will keep the plan in compliance, but not fully funded. That is where the recommended contribution comes into play.

There is no IRS guidance that defines the recommended contribution. Rather, it is simply an amount that, when contributed, increases the plan assets to a level equal to the plan liabilities (hypothetical account balance). Another way of putting it is that the plan sponsor is funding to a termination liability – meaning if the plan terminated after the contribution, the plan would have enough assets to pay out all of the promised benefits.

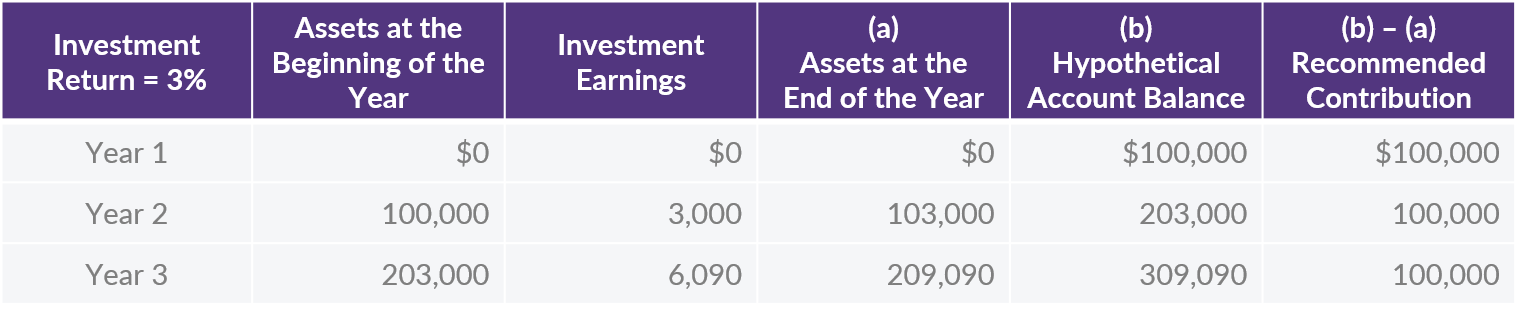

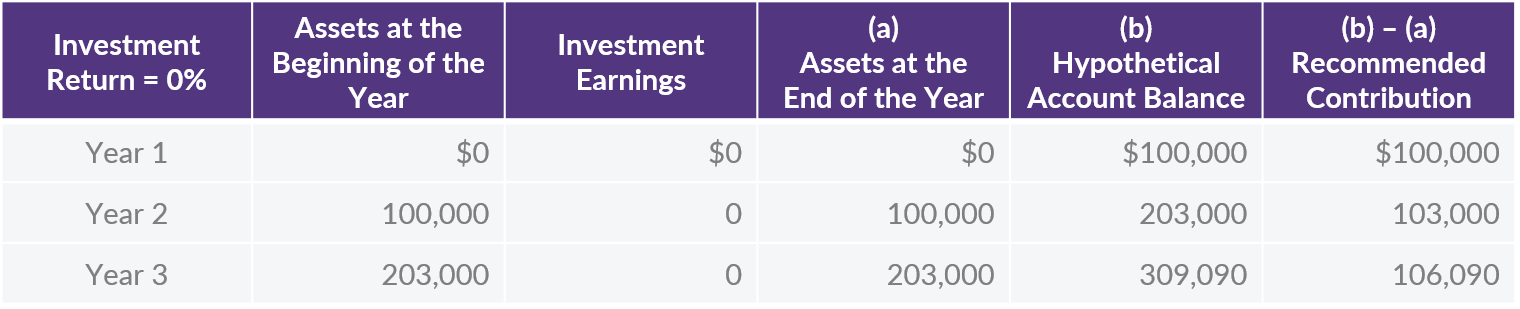

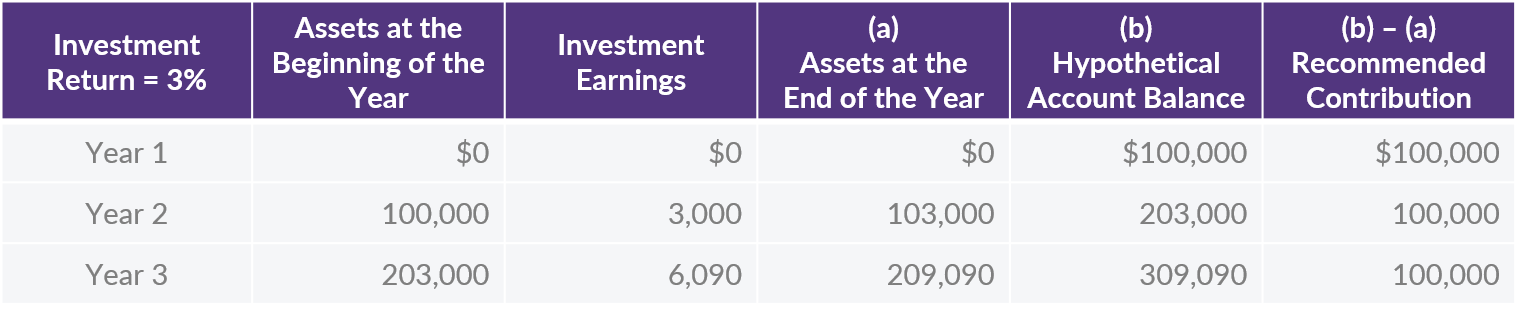

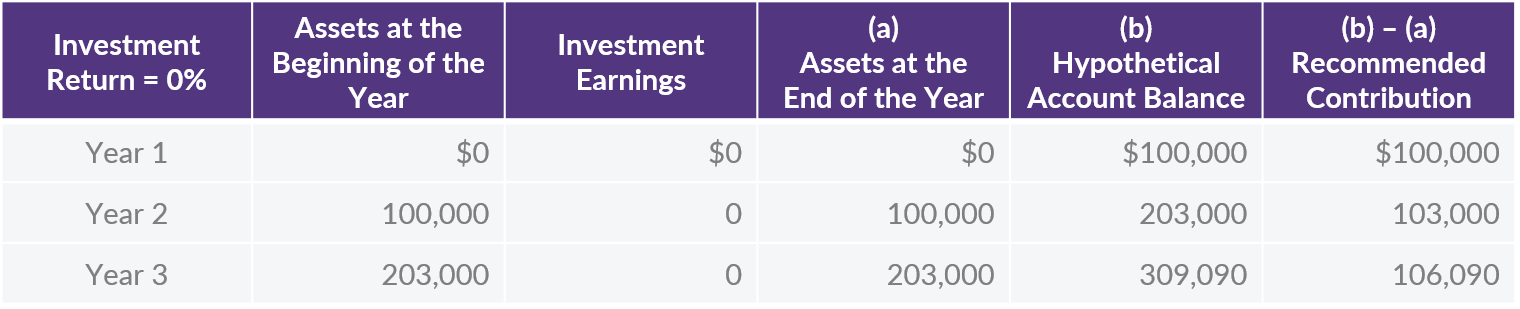

Let’s look at a few examples. Robert’s annual contribution credit is $100,000. Since there is no interest credit in the first year of the plan, the recommended contribution is $100,000. Now let’s jump ahead a couple of years like we did for the MRC examples. At the end of year three, we know that the hypothetical account balance will be $309,090. Below are examples of the recommended contribution amounts assuming that the recommended contribution was made in each of the first two years.

- If the plan’s actual investment returns each year are exactly equal to 3% (the plan’s interest crediting rate), the recommended contribution is always equal to the contribution credit.

- If actual returns are less than the 3% interest credit, the recommended contribution increases to make up for the lower earnings.

- If actual returns are greater than the 3% interest credit, the recommended contribution decreases as the “extra” earnings help fund the contribution credit.

So, the goal of the Recommended Contribution is to make sure today’s assets equal today’s promised benefits.

See, we promised there would be limited math in this one! Rest up, though, because we will dive into the Maximum Deductible Contributions next time, and that means some weird rules and more math.

Want a printable version of this article to take with you? Click here.

If a defined benefit plan makes sense for your company, DWC can work with you to design a plan that accomplishes your objectives while maintaining maximum flexibility. Contact us today to get started.