One and One Makes Five: Calculating the Minimum Required Contribution

In our last episode, we showed how the cash balance benefit for our owner, Robert Smith, accumulates over time. In our Perfect World (no offense Huey!), Robert contributes exactly $100,000 to the plan each year, and the investment return is exactly 3% to match the interest crediting rate. When Robert is ready to retire at the end of ten years, the assets in the plan exactly match the benefit due to Robert (i.e. plan liabilities). Robert rolls the entire value into an IRA, and all is good with the world.

However, we don’t live in a perfect world. Fortunately, there are contribution options (minimum, maximum and recommended) that provide plan sponsors a certain level of flexibility in funding a cash balance plan. Today we will focus on the minimum required contribution.

Rules and Regulations

One fortunate aspect of sponsoring a cash balance plan is that it provides for a higher deductible contribution than what is allowed in a 401(k) profit sharing plan. Like many things in life, we must take the good with the bad. In the case of a cash balance plan, the “bad” is a set of complicated rules that the plan sponsor must follow to maintain the tax benefits. All non-governmental entities that sponsor cash balance plans must fund their plans in accordance with rules and regulations spelled out in the tax code. For the most part, small companies like Robert’s must follow the same rules as large companies. There are a few differences, but none that are pertinent to today’s discussion.

For those who are looking for obscure facts to impress their friends, minimum required contribution (MRC) rules are found in Section 430 of the Internal Revenue Code. These rules were first put into place when ERISA was born in 1974, with the most substantive changes made in 2006. Prior to the MRC rules, companies did not have to pre-fund their DB plans. As a result, if a company went bankrupt, employees and retirees were left out to dry with no money set aside to pay the promised benefits (look up Studebaker and prepare for your friends to be even more impressed!).

So, why would Robert need to follow rules to make sure that his company is paying his own benefits? Because that’s what the rules say!

Calculating the MRC

Now that we know why Robert needs to fund the MRC, let’s find out what it is. The MRC is made up of two main components:

- Target Normal Cost (TNC): the value of benefits earned during the current year

- Funding Target (FT): the value of all hypothetical account balances earned to date

We know that Robert receives a contribution credit of $100,000 per year. We also know that the contribution credit will increase at our fixed 3% interest credit each year up to retirement. MRC rules state that the interest credit must be used to project that contribution credit to the retirement date, which is then discounted (using different mandated rates) back to the current year. Sound confusing? Just wait.

The discount rate used to determine the MRC depends on how far the participant is away from retirement, using one of three so-called “segment: rates:

- First segment rate: 0-5 years from retirement

- Second segment rate: 6-20 years from retirement

- Third segment rate: More than 20 years from retirement

Robert is 10 years away from retirement, so we would use the second segment rate. Let’s assume that the valuation date for the first year is January 1, 2020. The second segment rate on January 1, 2020 is 5.21%.

To determine the minimum required contribution in the first year, the $100,000 contribution credit is projected to normal retirement using the interest crediting rate (3%), then discounted back using the second segment rate (5.21%). So now you know the concept – below is the formula for those interested in jumping further into the weeds:

Robert is only required to contribute $80,873 to meet the MRC rules, but doing so will mean the plan’s total assets are less his hypothetical account balance.

The second part of the MRC is the amortization of any unfunded funding target. If we jump ahead to the beginning of the third year of the plan, Robert’s hypothetical account balance plus interest credit is $209,090.

Since we are in the third year of the plan, Robert is now two years closer to retirement, so the projection and discount periods are now both eight years instead of ten. We will assume the segment rate stays the same.

Again, diving into the weeds, the Funding Target (i.e. value of benefits already earned) is:

And the Target Normal Cost (i.e. benefits earned during the current year) is:

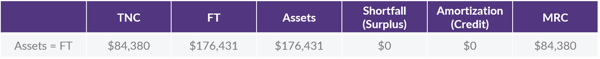

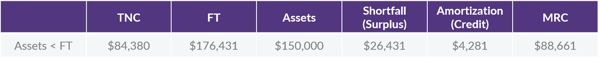

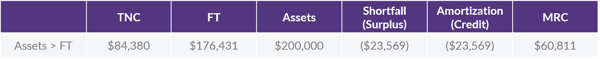

Now that we know the FT and TNC for the third year, we can look the minimum required contribution under a few scenarios.

- If actual assets are exactly equal to the Funding Target, the MRC is equal to the Target Normal Cost.

- If actual assets are less than the FT, then the shortfall is amortized over seven years (using the first and second segment rates) and added to the TNC, resulting in an increase in the MRC.

- If assets are greater than the FT, then the entire surplus is used as a credit against the TNC.

In other words, this is all just a long-winded way of saying that the Minimum Required Contribution each year is that year’s Target Normal Cost plus any shortfall amortization less any surplus. If you want to dig into the math on any of this, you might be a prime candidate to take the Enrolled Actuaries exam…on second thought, you could just give us a call.

Conclusion

A few takeaways before we wrap up. First, as long as the interest credit is at a fixed rate (and discount rates stay above that level), the TNC (and most likely the MRC) will be less than the actual benefit earned. Second, there is a lot of flexibility when the assets exceed the FT. In fact, there are many plans that, once passed the first few years of the plan, have no MRC at all even though benefits continue to accrue. Now, a plan sponsor cannot forgo a contribution indefinitely (and probably wouldn’t want to if tax savings is the name of the game), but it sure is nice to have a one-year contribution holiday should it be needed.

Our next couple of posts will dive into the recommended and maximum deductible contributions – both reasons why plans become overfunded on an MRC basis.

Want a printable version of this article to take with you? Click here.