From the Hot Seat to a Fireside Chat

This week, we are bringing the heat in two completely different ways.

Receiving notification that the Department of Labor is about to pay a visit to investigate your plan is enough to make you feel like you are sitting in the hot seat. And for good reason. In the first part of this week’s post, we bring you an update on the most recent statistics from DOL’s enforcement activities during 2020. While no one wants to feel that kind of heat, these numbers serve as an important reminder of the importance to work with service providers who really know their stuff to help avoid getting into hot water in the first place.

Switching gears to something a little bit lighter, last week saw the very first installment of the American Retirement Association’s Fireside Chats, and DWC was a part of it.

2020 DOL Enforcement Results

Toward the end of each calendar year, the Employee Benefit Security Administration (EBSA – the division of the DOL that works with employee benefit plans) publishes statistics on its enforcement activities for the preceding year.

Here is a link to their fact sheet with statistics for the fiscal year ended September 30, 2020, but it is the context and year-over-year comparisons that are more interesting.

During fiscal year 2020, EBSA recovered more than $3.1 billion, an increase of more than $550 million from the previous year! That’s a lot of money!

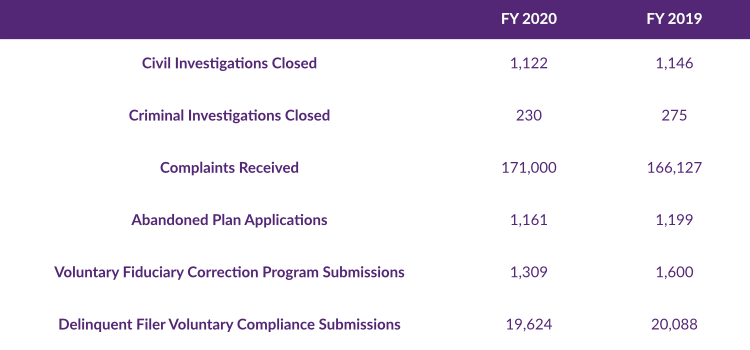

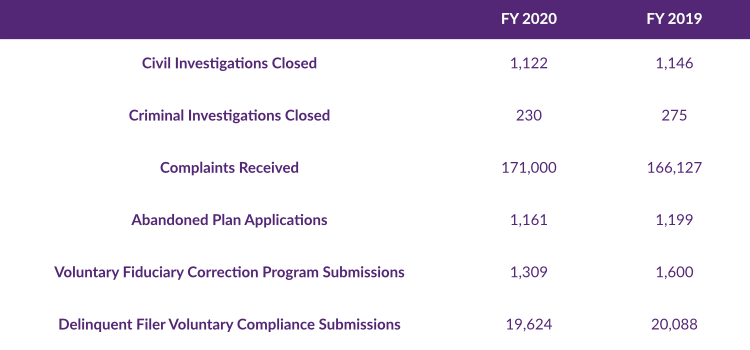

Here is a quick rundown of some of the other key facts and figures:

It is interesting to note that even though the number of cases decreased from 2019 in just about every category, total monetary results increased by a half a billion dollars. Since they do not publish the details behind the statistics, it is not clear whether this means DOL is focusing its enforcement activities on larger plans/employers or if they are being more aggressive in the amounts they seek to recover across the board.

One number that always stands out is the number of inquiries, e.g. complaints, that EBSA receives each year. Not only that, but they act on those inquiries, opening up more than 350 investigations during FY 2020.

Another tidbit that caught our attention is how the numbers have changed over the last four years as compared to the previous four-year-period. From 2016 through 2020, total plan assets restored/participant benefits recovered increased by a whopping 600%! Compare that to an increase of about 85% from 2012 through 2016.

Why look at those two periods? Because they correspond to the administrations of the two different political parties (Democratic Party in 2012 – 2016 and Republican Party from 2016 – 2020). As a general rule, Republican ideology tends to be focus on helping businesses (pro-employer), while the Democratic positions tend to focus on consumer protection (pro-employee). So, the changes over these two periods is noteworthy, because they are opposite of what one might expect. With the Democratic Party now controlling the White House and Congress, it will be curious to see how these enforcement results change over the next few years.

If you want to dig more into the numbers, be sure to check out our Historical DOL Enforcement Results page for more information.

Fireside Chat: Our Joe Nichols with Brian Graff

DWC’s very own Joe Nichols participated in the first ever American Retirement Association Fireside Chat last Thursday. In these informal conversations, Brian Graff (the ARA’s CEO) chats with someone from the industry about a range of topics from how they got into the business to what prompted them toward industry volunteerism to their perspectives on where the industry is headed. The good news is that with Joe as a partner here at DWC, we and those who work with us have access to his insights all year!