Historic DOL Enforcement Results

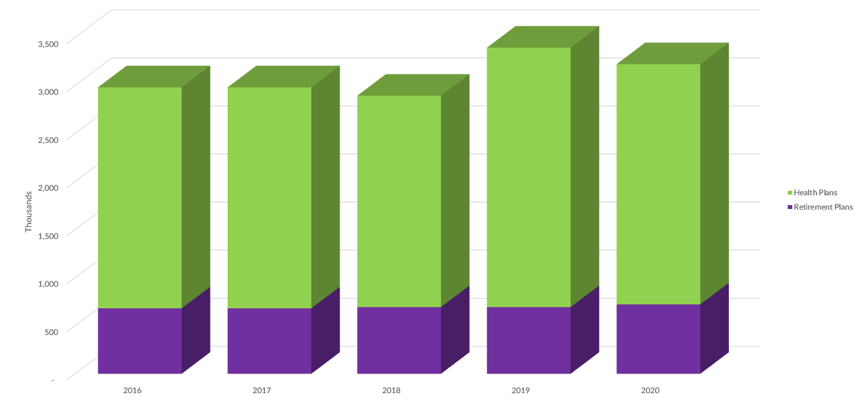

The Employee Benefits Security Administration (EBSA) is the division of the Department of Labor (DOL) that is responsible for ensuring the integrity of the private, employment-based benefit system. Their oversight extends not only to retirement plans, but also to health and other welfare benefits plans covering millions of workers and their beneficiaries with total assets in the trillions of dollars.

EBSA's Oversight Authority by Plan Type

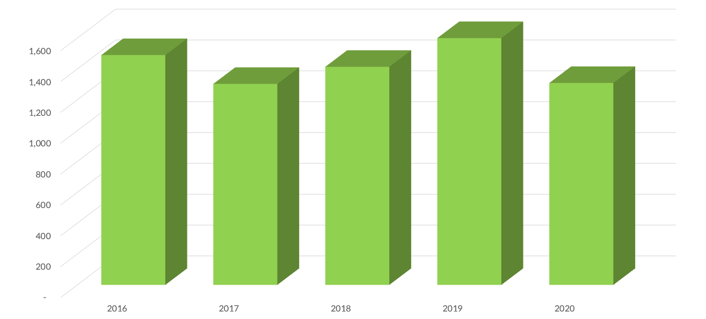

Total Employees & Beneficiaries Covered Under EBSA Authority

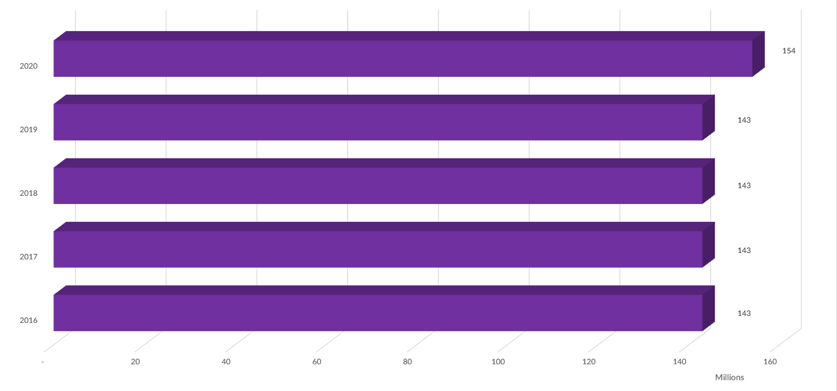

Total Assets Under EBSA Authority

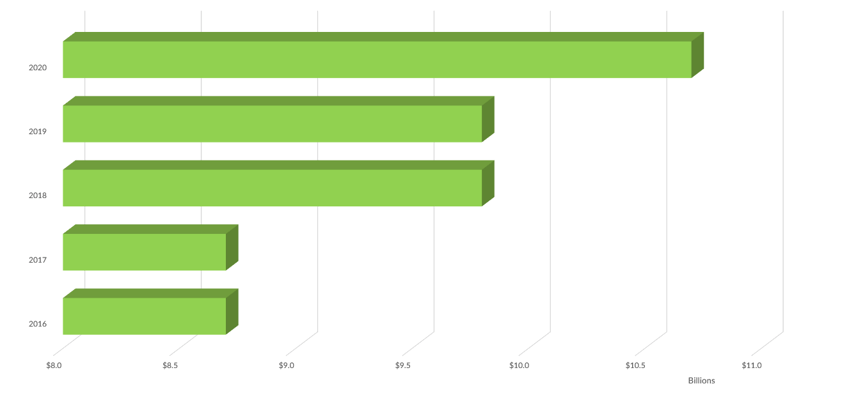

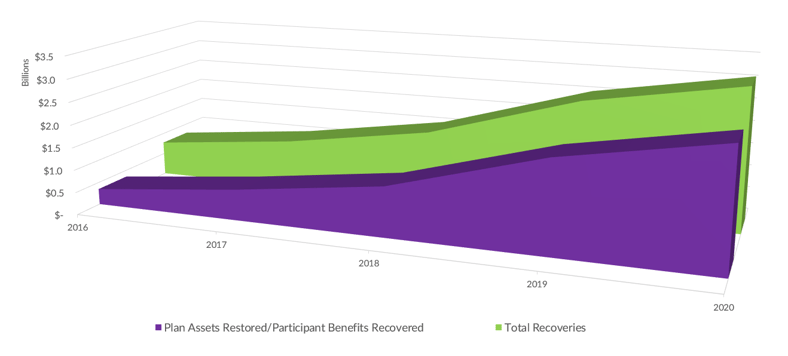

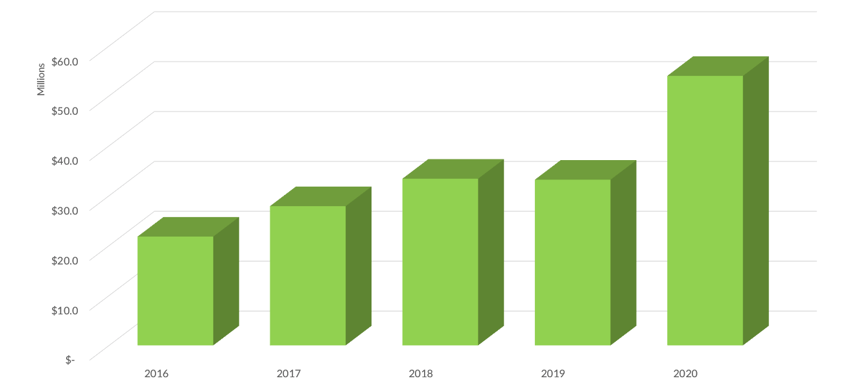

Total Monetary Results

Each year, EBSA investigations result in substantial recoveries, including a significant amount on behalf of former employees who are still owed benefits from their prior employers’ plans. Total monetary results in 2014 were almost $600 million, and that amount increased to more than $3.1 billion in 2020.

Total Monetary Results

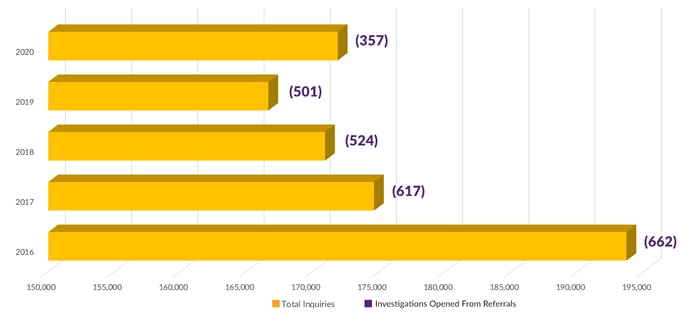

Informal Complaint Resolution

When a problem arises, it is not uncommon for any business owner to assess the risk of non-compliance against the cost of correction. One factor in that equation that is sometimes overlooked is that employees who believe they have been wronged can and often do complain to the DOL. In fact, DOL representatives review close to 200,000 employee complaints each year! Anecdotally, employees appear less likely to make formal complaints when the economy is generally stronger and more likely to complain when they feel less financially secure. That would explain, at least in part, the spike to nearly 400,000 complaints in 2010 (during the tail end of the recession) and the downward trend in the number of complaints almost every year since then. If past results hold true, we may expect to see an uptick in complaints due to the economic uncertainty around COVID.

If an inquiry cannot be resolved or if EBSA becomes aware of repeated complaints within a particular plan or employer, the matter is referred for formal investigation.

Investigations Opened from Inquiry Referrals

Benefits Recovered

"Anecdotally, employees appear less likely to make formal complaints when the economy is generally stronger and more likely to complain when they feel less financially secure. That would explain, at least in part, the spike to nearly 400,000 complaints in 2010 (during the tail end of the recession) and the downward trend in the number of complaints almost every year since then." Adam Pozek, Partner & Chief Financial Officer at DWC

Correction Programs

In addition to its investigatory activities, EBSA maintains two voluntary correction programs:

- The Voluntary Fiduciary Correction Program (VFCP), and

- The Delinquent Filer Voluntary Compliance Program (DFVCP).

Both are designed to encourage plan sponsors and fiduciaries to voluntarily correct ERISA violations by providing user fees that are much less than what the otherwise applicable penalty might be.

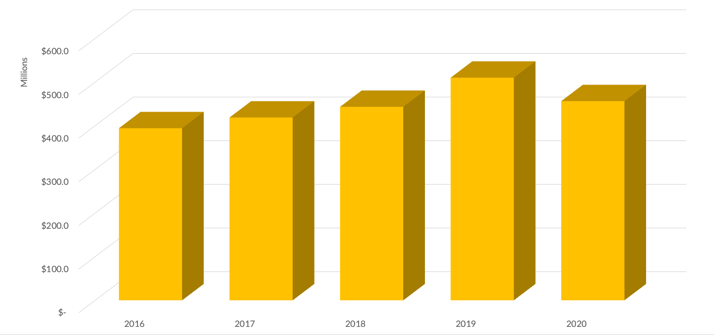

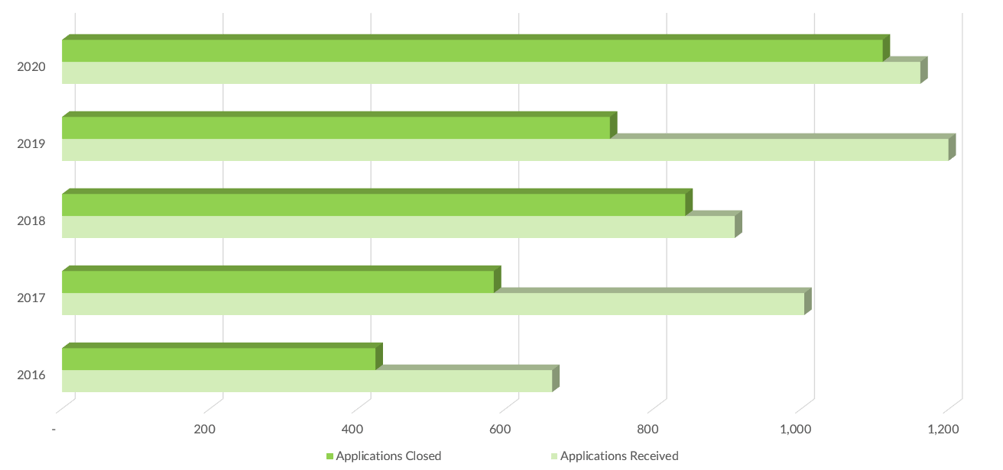

DFVCP allows plan sponsors to correct the late filing of the Form 5500, which is generally due by the end of the seventh month following the close of the year, i.e. July 31st for calendar year plans. The program is very easy to use and requires only that the sponsor file the delinquent form and pay the user fee (which ranges from $750 to $4,000, depending on the size of the plan and the number of forms that are late).

DFVCP Applications

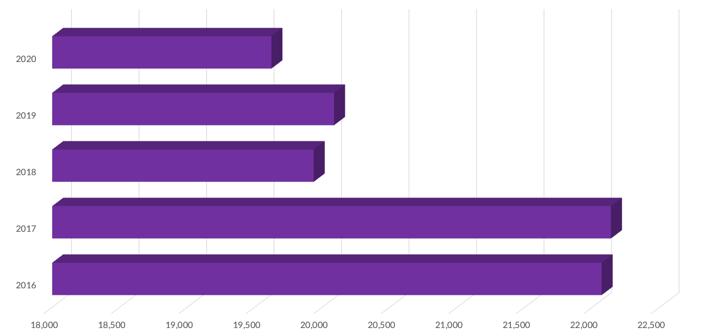

VFCP allows for the correction of several types of prohibited transactions, ranging from the late deposit of employee 401(k) deferrals to a plan fiduciary or other interested party buying or selling an asset from/to the plan. Since these instances are fewer and further between, VFCP is not used as frequently as DFVCP; however, these prohibited transactions can carry much steeper penalties, so VFCP is an important tool when such transactions do occur. There is no user fee for this program, but there is a detailed application that must be submitted (along with supporting documentation) so that EBSA can review and approve the proposed correction.

VFCP Applications

Civil Investigations

From time to time, EBSA and a plan sponsor/fiduciary reach an impasse, and any efforts at voluntary compliance fail. When that happens, the Department of Labor can initiate litigation to compel corrective action and penalize non-compliance. Together, EBSA and Solicitor of Labor determine which cases are appropriate for litigation – considering the ability to obtain meaningful relief, cost of litigation, and the viability of other enforcement options. Even after referral for litigation, the DOL can often resolve claims for monetary relief without filing suit. In many cases we’ve seen where litigation has occurred, the DOL gave the plan sponsor/fiduciary multiple opportunities to negotiate a mutually agreeable settlement, but the plan sponsor/fiduciary became defiant or non-responsive.

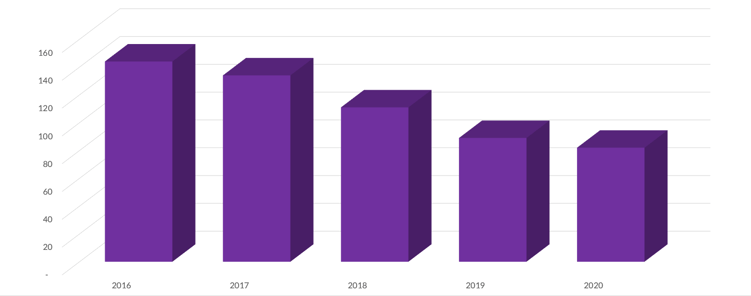

Civil Investigations Referred for Litigation

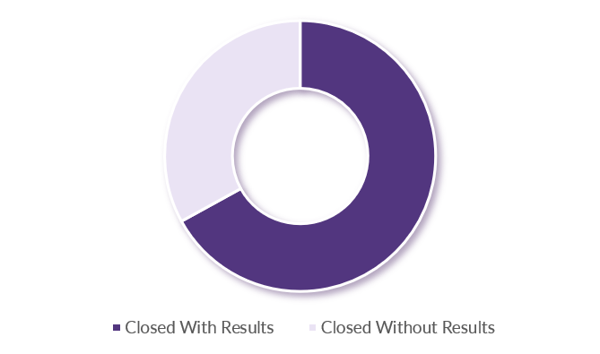

Civil Investigation Outcomes

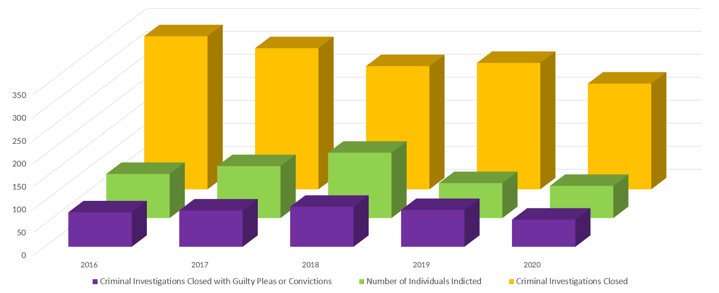

Criminal Investigations

Although not likely to ever be the subject of an episode of Orange is the New Black, ERISA jail is a real thing…at least, it is possible to go to prison for an ERISA-related crime. DOL does occasionally investigate potential violations of ERISA’s criminal provisions alongside other federal and state law enforcement agencies. The most common example is theft of plan assets. While outright theft is an obvious crime, other less obvious actions can also become criminal in nature. This might include a situation where a plan sponsor fails to deposit employee 401(k) deferrals, which starts out as an easy correction under the VFCP but can escalate to a crime if not corrected despite repeated warnings from the DOL.

The DOL maintains an archive of press releases about its criminal enforcement activities on its website.

Criminal Investigation Outcomes

Abandoned Plan Program

The Abandoned Plan Program facilitates the termination of, and distribution of benefits from individual account pension plans that have been abandoned by their sponsoring employers. This often involves situations where a company has gone out of business without formally terminating its retirement plan, and the plan officials (usually he business owners) cannot be located or are not responsive.

Resolved Abandoned Plan Applications

Distributions Paid to Participants

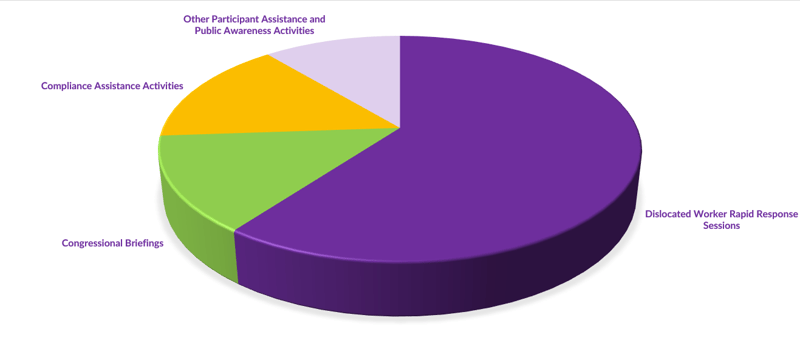

Outreach, Education & Assistance

EBSA also conducts education and outreach events for works, employers, plan officials and members of Congress. These nationwide activities include assisting workers facing job loss, educating employers of their obligations under ERISA, informing Congressional staff of EBSA programs for their constituents, and providing employees with information concerning their rights under the law.

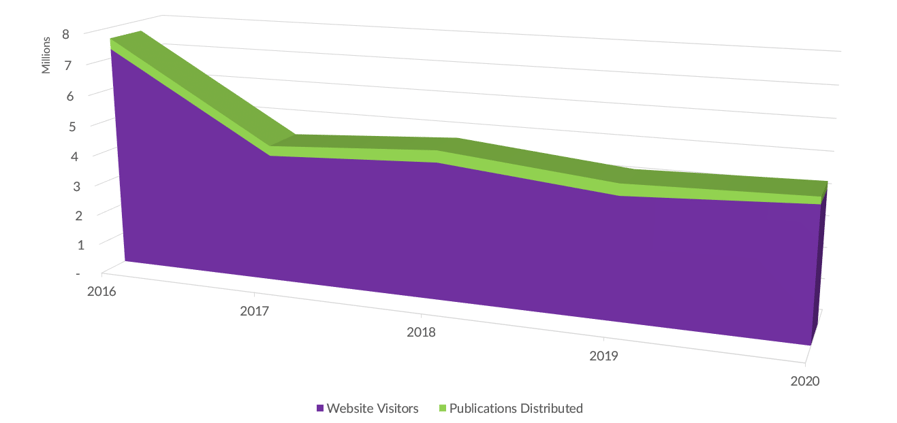

The administration also reaches workers, retirees, employers, plan service providers and the public through its printed materials and website at www.dol.gov/agencies/ebsa. Visitors can view and receive consumer information, relevant laws and regulations, technical guidance, and other valuable resources.

ces.

Outreach & Educational Events

Website & Publication Traffic

SOURCE: U.S. Department of Labor Agency Enforcement Results Archive