Plan Corrections

The rules that govern retirement plans are voluminous and complex. The Pension Protection Act, passed in 2006, is just one of many laws that applies, and it is over 1,000 pages long. The Department of Labor’s regulations on fee disclosure clock in at another couple hundred pages, and the instructions for the annually required Form 5500 are nearly 100 pages…just the instructions!

With so much to keep up with, it is usually a question of “when” not “if” even the most diligent of plan sponsors will have a misstep involving their plans. Even though fiduciary topics get most of the press, the tax rules are just as important and are actually more likely to be the source of mistakes for most plans. One of the main reasons is that many of the fiduciary rules apply subjective standards such as “reasonableness” or “best interest” whereas, the tax-related requirements often have hard-coded thresholds for what is acceptable and what is not.

Because of the complexity of the rules, many plan sponsors do not even realize there has been an oversight until one of the following occurs:

-

the TPA performs the year-end compliance work;

- the plan’s Independent Qualified Public Accountant performs the annual audit that accompanies the Form 5500 (only for large plan filers); or

-

the plan is tagged for a Department of Labor or IRS compliance audit.

Fortunately, both the IRS and Department of Labor have established plan correction programs to help plans get back on track after the inevitable accident has happened.

- Employee Plans Compliance Resolution System (IRS)

- Voluntary Fiduciary Correction Program (DOL)

- Delinquent Filer Voluntary Compliance Program (DOL)

Employee Plans Compliance Resolution System (EPCRS)

Often referred to by its acronym, EPCRS (pronounced

- Demographic

Failure Occurs when one of the annually required nondiscrimination tests fails and is not corrected on a timely basis. - Employer Eligibility Failure Occurs when a company sponsors a type of plan it is not permitted to sponsor. An example would be a for-profit company sponsoring a 403(b) plan (which can only be maintained by certain not-for-profit entities).

- Plan Document Failure Occurs when a plan document includes language that is not permitted or excludes language that is required. The most common example is when a plan sponsor misses a deadline for a mandatory plan amendment or restatement.

- Operational Failure Occurs any time a plan is not operated in strict accordance with the provisions in the plan document.

EPCRS provides step-by-step plan correction instructions for some of the more common types of mistakes. But, unlike the DOL’s correction programs, it also allows quite a bit of flexibility for plan sponsors to craft their own corrections (acting in good faith) when the specific facts do not fit neatly into the IRS examples. Even though there is flexibility, it is critical to remember that the correction should place

There are three sub-programs within EPCRS. One of them – the Audit Closing Agreement Program – only comes into play if the IRS discovers the problem before the plan sponsor does. Since we are focusing on fixing mistakes before the IRS comes knocking, we’ll skip that one.

The other two are the Self-Correction Program and the Voluntary Correction Program. We have highlighted these programs in use in our Correction of the Quarter column.

- Self-Correction Program (SCP): Allows plan sponsors to correct a mistake without seeking formal IRS approval. It is only available for operational failures that are either insignificant or those that are caught and corrected within two years.

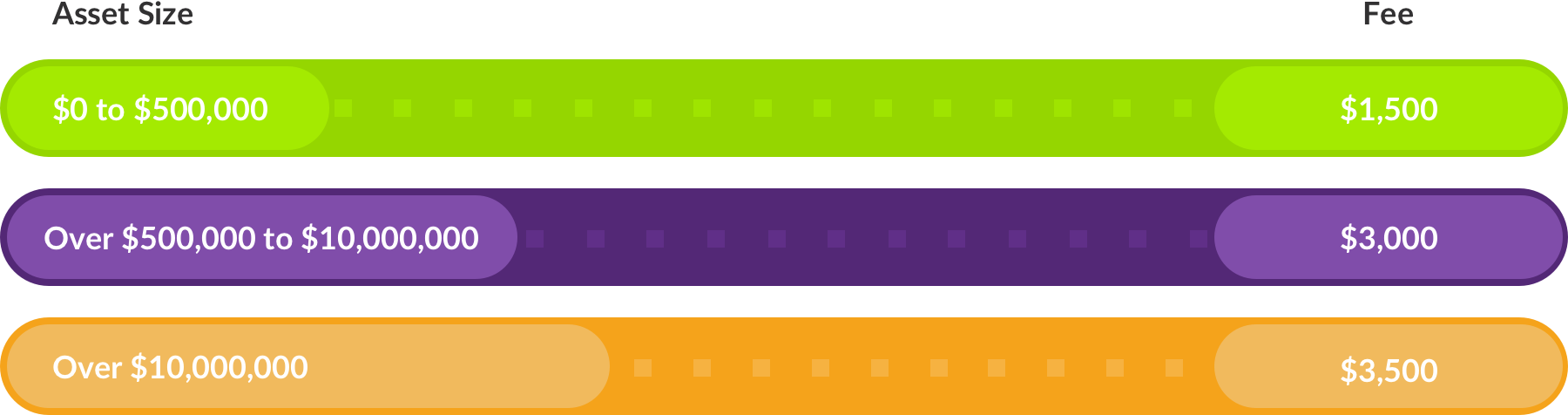

- Voluntary Correction Program (VCP): Is available to correct all types of mistakes, including those operational failures that do not qualify for SCP, and requires submission of a formal application for approval by the IRS. The application must be accompanied by certain forms and documents along with a fee based on the plan’s asset size:

Voluntary Fiduciary Correction Program (VFCP)

The Voluntary Fiduciary Correction Program (VFCP) is one of the plan correction programs maintained by the Department of Labor. Unlike EPCRS, which focuses on compliance with the tax rules, this program focuses on fiduciary duties. Also unlike the IRS program, VFCP offers very little flexibility:

- Only certain specific types of failures can be corrected.

- Correction must follow one of the methods spelled out by the DOL in the program.

- All corrections must be submitted to the DOL for approval. There is no self-correction.

On the bright side, the DOL does not charge a user fee to review applications.

Probably the most common error we see that falls under this program is when employee 401(k) deferrals (and participant loan payments) are not deposited into the plan on a timely basis. For detailed instructions on how to correct this particular error, read this Correction of the Quarter.

Delinquent Filer Voluntary Compliance Program (DFVCP)

This DOL program is probably the most straightforward of the bunch. Its sole purpose is to allow plan sponsors to get caught up on past due Forms 5500. All that is required is that the Forms be filed and that the plan sponsor pays a user fee:

- Small plan filers (generally those with fewer than 100 participants): $750 per late form, subject to a cap of $1,500 if more than two delinquent forms are filed at the same time.

- Large plan filers (generally those with more than 100 participants): $2,000 per late form, subject to a cap of $4,000 if more than two delinquent forms are filed at the same time.

Both agencies are committed to these programs, and Congress has even directed the IRS to expand EPCRS to make more mistakes eligible for self-correction. Even though plan sponsors should not be intimidated by or afraid of using the plan correction programs, the processes for correction are quite detailed. Hiring an experienced firm to work through those processes with you is critical. Fortunately for you, if you are reading this page, you have already found just such a firm.

In order to be eligible to correct an operational error under the EPCRS self-correction program, one of the first steps is to determine whether the failure is significant or insignificant. While determining the significance of failure is always going to be somewhat subjective, you can take some of the guesswork out of it by downloading our significance of failure calculator.