Can Higher Than Normal Turnover Affect my 401(k) Plan? | Part 2 of 3: Doing the Math

Facts

Last week, we asked whether the turnover we are expecting as a result of closing a facility would have any impact on our 401(k) plan, and you mentioned a partial plan termination. We have some follow-up questions. As a quick recap, we are in the process of closing one of our manufacturing facilities. Some of those working at that location have turned down our relocation offer and will lose their jobs as a result. From last week’s QOTW, I know there is potential for a partial plan termination and that I will need to perform a review to make a final determination.

Question

How do I identify the employees that should be included in this review? Also, once those employees are identified how is the actual turnover rate calculated?

Answer

This is where we get into the nuts and bolts of this thing, but it will probably make more sense if we apply the concepts to some actual facts and figures. We will assume the following facts:

- Your facility will close over a 24-month period, from July 1, 2019 through June 30, 2021.

- Your current workforce consists of 225 employees, 185 of which are eligible for your plan.

- You anticipate adding 15 new participants during the period of the closure.

- There are 45 participants who will lose their jobs as a result of the closure.

Defining the Measurement Period

If you recall from last week, we noted that although the measurement period is often the plan year of the turnover, it could be much longer (and even span several years) if there is a series of related events over a longer period that contributes to the turnover.

As an example, the recent economic recession officially ran from December 2007 through June 2009; however, many segments of the economy experienced repercussions well into 2010 or longer. So, if the recession drove turnover for a company, the measurement period for whether there was a partial termination could span all or a part of 4 calendar years.

Using our assumed facts above, the measurement period would likely span the entire 24-month period the facility closure but could start earlier or last longer.

Classifying Employees

Once the measurement period is determined, you can proceed to classify the employees into their applicable groups:

- Total number of participants at the beginning of the measurement period,

- Total number of new plan participants during the measurement period, and

- Total number of employees who lose plan participation during the measurement period.

We should note here that “participant” means any employee who is eligible for the plan and not just those who are actively contributing or who have a balance. It is also important to note that those employees who are not and do not become eligible at any point during the measurement period are disregarded for this determination.

The first two groups are pretty straight-forward. These folks are essentially the employees who were eligible for any component of the plan as of the start of the measurement period and any new participants through the remaining period of review, respectively.

The third group can be tricky. Those whose loss of participation is directly tied to the facility closure are obvious. But those who are indirectly affected must also be identified. This group includes any employees who may sense something is coming and voluntarily resign on their own schedule rather than sticking around to see if they would be terminated. In fact, the IRS has interpreted this so broadly, that almost any employee who loses the ability to participate during the measurement period – whether employee or employer initiated and regardless of whether it is routine or extraordinary – must be considered when calculating the turnover rate.

Doing the Math

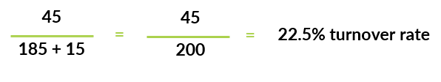

Now, that we have our groups of employees, let’s turn our attention to the formula to determine our actual turnover rate. Fortunately, this is the easy part.

Let’s see what it looks like when we add the figures noted above.

At the beginning of your measurement period, you have a workforce of 225 employees, but only 185 of those are eligible to participate. You expect to add 15 new participants over the measurement period, and you anticipate that 45 existing participants will terminate employment and lose the ability to participate in your plan. Plugging those numbers into our formula, here is where we stand.

Given that the turnover rate exceeds 20% and is a direct result of company actions, this seems like a pretty open and shut partial termination. In next week’s QOTW, we will dig into what happens when you have a partial plan termination.

If you think you might have experienced a partial plan termination reach out to us, we are happy to provide support! For more information about partial plan terminations, please visit our Knowledge Center here.

Want a printable version of this article? Click here.