Does Counting Hours of Service for Plan Eligibility Have to be a Nightmare?

Facts

We’ve been following along with the last few Questions of the Week and think we’re pretty comfortable with how we want to set up eligibility for our 401(k) plan. We’re definitely looking to implement a one year of service requirement (with 1,000 hours during that year) and quarterly entry dates. We understand that this design may result in some part-time employees entering the plan if they satisfy that 1,000-hour requirement, and we are not looking to exclude any groups of employees from the plan. Basically, we want to make this clean and simple for everyone involved.

Question

There is one more area where we hope there is a simple answer. What do we do if someone doesn’t meet the eligibility requirements during their first year? With the number of part-time employees we have, we’re worried this could be an administrative nightmare.

Answer

No need to hide under the covers! The plan document builds in options to help you effectively manage this without haunting your HR department.

You noted above that you want to count the actual hours each person works (rather than just the passing of time) to establish when an employee has met the one-year requirement. So here comes the question to consider next…which twelve-month period do you use?

We touched on this briefly last week, but it is certainly worthy of a more detailed look. There are two different anniversary dates you can consider when computing eligibility:

- Employment anniversary dates; or,

- Plan year anniversary dates.

Let’s take a look at both options along with an example of how they work. For both, we will make the following assumptions:

- Johnny is hired on August 1, 2020.

- The plan operates on a calendar year.

- The eligibility service requirement is 1,000 hours in a 12-month period.

- Plan entry dates are the first day of each calendar quarter.

Employment Anniversary Dates

These are exactly what they sound like - the computation period is based on the anniversary date of the employee’s date of hire. Since Johnny’s date of hire is August 1, 2020, you would look at the hours he works from that date through July 31, 2021.

If he works at least 1,000 hours by July 31, 2021, he satisfies the eligibility requirement and enters the plan on October 1, 2021. If he does not hit 1,000 hours in his first year, then you would count his hours during his second anniversary year (from August 1, 2021 through July 31, 2022) to determine whether he meets eligibility. If so, he would enter the plan on October 1, 2022 (assuming he is still employed).

Easy enough! Maybe not. While using the employment anniversary seems logical for the initial twelve-month period or if you are only dealing with a single employee, it can get complicated quickly. The reason is that because each employee has a different employment anniversary, each and every person who doesn’t satisfy the service requirement in his/her first year will have his/her own unique ongoing twelve-month period to keep track of each year, thereafter.

Here’s what that looks like in reality: if you hire five part-time employees in 2020 and none of them satisfy the hours requirement during their first year, your HR team now has five different anniversary dates to track and review each year (until the employee enters the plan or terminates employment). We know, no one loves the sound of that option.

Plan Year Anniversary Dates

Luckily, we’ve got a solution for you. (Bet you saw that coming.) Rather than continuing to use employment anniversary dates, you can elect within the plan document to switch to the plan year as your measurement period after that initial anniversary year. The benefit here is that after year one, anyone who doesn’t satisfy the 1,000-hour requirement to enter the plan is switched to the same anniversary date going forward, which makes this review so much easier.

Let’s go back to our friend Johnny.

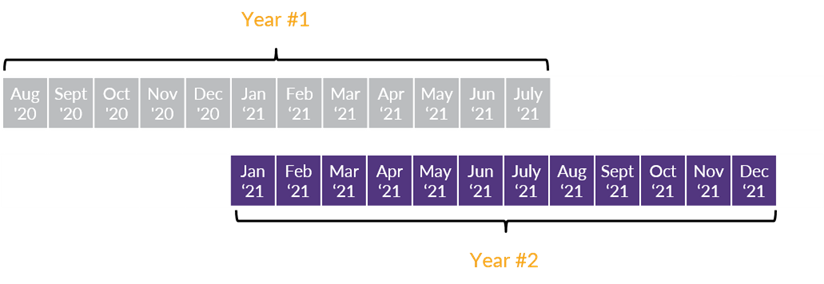

The first year is the same as in the previous example. That means if Johnny hits his 1,000 hours by the end of that year, he still enters the plan on October 1, 2021. However, if he falls short in year one, we shift to the plan year (January 1, 2021 – December 31, 2021) as the second year and look at that timeframe to determine whether he reaches 1,000 hours. If so, he enters the plan on January 1, 2022 (again, assuming he remains employed on that date), a full 9 months earlier than when using the anniversary of being hired.

Using employment anniversary dates results in the maximum waiting period for new hires, but it comes at an administrative cost. If you have multiple employees who do not satisfy eligibility during their first twelve months of employment, tracking subsequent employment anniversary years for each of them can be an enormous amount of work that snowballs each year. Whereas, switching to the plan year makes for an easier, more consolidated effort in future years, but the trade-off is that some employees may enter the plan earlier.

We all know that forgetting an anniversary can get you in trouble and that holds true with your retirement plan too. See, the plan year method has other perks in addition to saving time; there’s also the reduction in potential errors, like missed deferral opportunities, that can be a real headache and expense.

Here’s the thing, we know everyone is time-crunched and looking for the easiest way to administer a plan. We also know that plan sponsors want to get it right and avoid costly errors. Looking at a seemingly simple provision such as the computation period for eligibility can make a big difference when it comes to plan operations. And a change with a big impact doesn’t have to be difficult at all. In fact, a change like this one is easy to do as part of the IRS-mandated plan document restatements and can easily be combined with some of the other eligibility pointers we covered in the last couple of weeks. If you’re not sure how your plan document is written, let DWC take a look with you. We want your plan design to allow for sweet dreams and easy days!

Want a printable version of this article? Click here.