Service providers are judged by by many factors and one of the most important is managing to zero service issues. And considering how important plan compliance is, issues with plan compliance via a government audit is not considered a factor—until it is.

But it doesn't mean your third party administrator shouldn't blow you and your clients away as soon as the engagement starts. That initial setup/conversion process is critical for a plan sponsor and can define how well (or poorly) the working relationship will be with the service provider. It should be dynamite.

Unfortunately, plan sponsors can sometimes miss out on this process if the TPA is not hired directly by the sponsor via an investment advisor. Not convinced it's a big deal? Here's what the DWC first impression process includes:

Proposal/Plan Design Projection Report

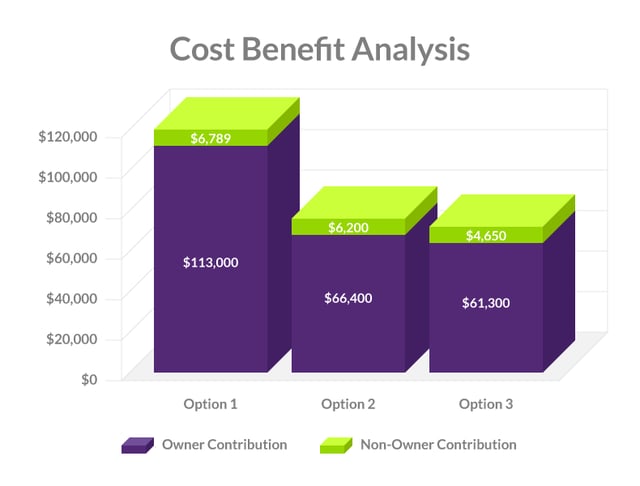

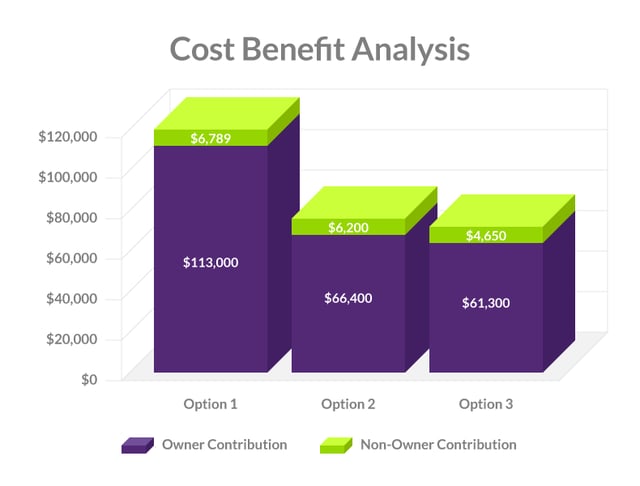

Whether you win or lose, you have provided a cost benefit analysis that makes you and your firm look good. Over 80% of all prospects we prepare the Plan Design Projection Report with a sales proposal result in a ‘win’.

This report also sets the tone from a compliance and fiduciary perspective, eliminating compliance surprises such as failed ADP tests, top heavy contribution requirements, or large year-end true-ups for a safe harbor match.

Example cost benefit analysis from a DWC Plan Design Projection Report

Example cost benefit analysis from a DWC Plan Design Projection Report

Welcome Package

Upon being awarded the business, all clients receive a customized welcome package that clearly outlines all roles and responsibilities. Dependent on the selected recordkeeping service provider, we make sure your first experience uploading a payroll with the recordkeeping system is as easy as possible.

Plan Document Package

Our plan document process includes a Summary of Plan Provisions, Plan Document Package, and a review phone call. This is the legal document that governs the operations of the plans—it must be followed. Which is why we actually take the time to listen to clients and prepare a document that works for their company from an operations and compensation/benefits perspective.

Way too many plan sponsors engage a service provider who asks only that they fill in a one-page checklist that results in operation and compliance issues in the first two years. And sure, it's great if the TPA can handle those compliance issues, but wouldn't be better if they didn't come up in the first place because the plan sponsor was onboarded the right way? For more information on fiduciary duties and due diligence, visit our Knowledge Center here.