How Much Fidelity Bond Coverage Are We Required to Have?

Facts

We are in the process of reviewing all our various business insurance policies to determine which ones we need to keep, update, or eliminate. One the coverages on our review list is the fidelity bond for our 401(k) plan. Although our plan does invest some in regular mutual funds (about $200,000), the plan also holds some non-traditional assets ($250,000 in limited partnerships and $1.5 million in real estate). I’ve read that we need anywhere from 10% to 100% of plan assets in coverage, but that this seems like a pretty broad spread.

Question

How do I figure out the correct amount of fidelity bond coverage my plan must have to satisfy the requirements?

Answer

It’s totally understandable that a 90-percentage-point spread might seem unreasonably broad, especially since these rules are less than crystal clear to begin with. It is certainly important to make sure you have enough coverage, but no one wants to over-spend on insurance, even in the most stable of economic conditions.

As with so many plan-related questions, there is a general rule and an exception. Let’s take a look.

General Rule

The general requirement is that a plan must have a fidelity bond equal to at least 10% of the total assets in the plan. Under this general rule, the minimum bond amount is $1,000 (covers you on total assets up to $10,000), and the maximum bond is $500,000 (for plans with assets of more than $5 million). The “measurement” date is the first day of each plan year. That means even though asset levels fluctuate daily, the plan meets its bonding requirement if the bond meets these parameters based on assets as of the first day of each year.

Exceptions

When plans hold certain types of non-traditional assets, there are additional bonding requirements. Referred to as non-qualifying assets, these include things like your plan’s limited partnerships and real estate. If those types of investments comprise more than 5% of total plan assets, the plan’s bond must cover 100% of those amounts. Just like the general rule, the measurement date is the first day of the plan year. Before working through an example, we should mention that this increased bond isn’t strictly required. The alternative would be for you to engage an independent CPA to audit the plan on an annual basis the same way that larger plans are required to. However, since that price tag can easily run into the high four figures to low five figures, the extra bonding is pretty much always the more cost-effective option.

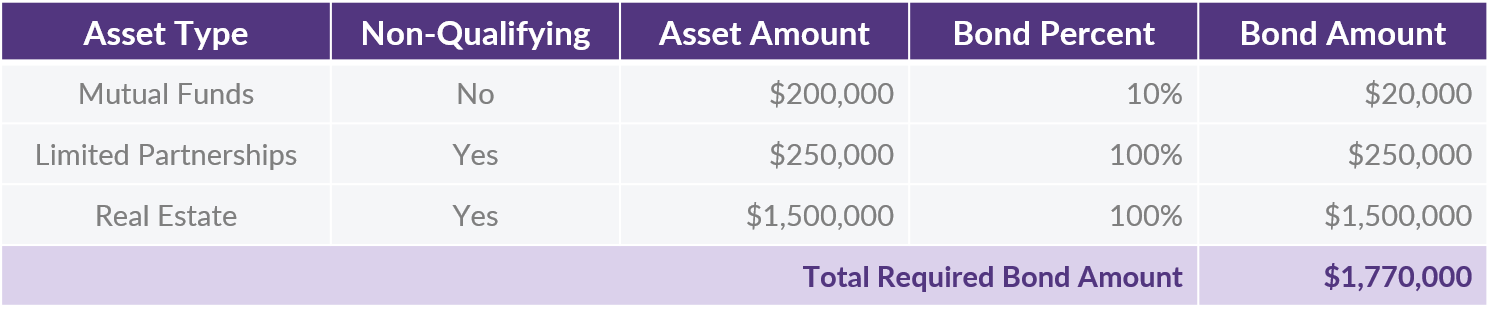

Let’s go through a quick example using the asset figures you noted above. Typically, the first step would be to confirm whether or not the non-qualifying assets exceed 5% of total plan assets. However, in this case, it is obvious without any calculations that the $1,750,000 in non-qualifying assets well exceeds 5% of the plan’s total assets of $1,950,000.

Valuation of Non-Qualifying Assets

Once you know how it works, the calculation is relatively straightforward. However, determining the fair market value of non-qualifying assets so that you can determine the correct bond amount can be a little more difficult. The reason is that the Department of Labor (the agency with jurisdiction over these rules) wants to see that the value is set by someone who has expertise in valuations and is independent from the plan and the company.

As these two DOL letters confirm, it is not sufficient to take the word of a real estate agent (in the case of real estate) or the general partner (in the case of a limited partnership). In fact, the DOL considers it to be a breach of fiduciary duty to not obtain a valuation from a duly qualified and independent source. And since plan auditors typically need to see documentation that supports the fair market valuation of plan assets, this requirement applies even if you were to opt for the audit rather than the increased bond.

Keep in mind that you’re required to report the fidelity bond coverage amount as well as the small plan audit waiver on the plan’s Form 5500 each year. This means the DOL is regularly collecting data on plan assets, types of assets, coverage, and audit requirements of each plan. If a plan claims the small plan audit waiver by virtue of meeting the additional bonding requirement and then fails to maintain the necessary coverage, the DOL considers the plan to have not filed a 5500 at all. If this happens, you’ll find yourself engaging a CPA to audit the plan anyway, filing a new Form 5500, and paying non-filer penalties.

Obtaining formal valuations and securing additional bond coverage may seem like extra work but compared to the alternative of going through an annual audit, it can be a piece of cake.

If you have specific questions regarding your plan’s fidelity bond coverage, feel free to reach out to a member of our team to discuss!

For more information about fidelity bonds and investing plan assets in real estate, please visit our Knowledge Center here and here.

Want a printable version of this article? Click here.