Nondiscrimination Testing: ADP & ACP Tests

The actual deferral percentage (ADP) and actual contribution percentage (ACP) tests are two of several nondiscrimination tests a plan must satisfy in order to remain compliant with IRS rules.

Some of the tests plans must focus on things that do not require any action on the part of plan participants. The ratio percentage test is based on the headcount of those who receive benefits, rather than the amounts they receive. The compensation ratio test considers the pay each participant receives. The ADP and ACP tests, on the other hand, reviews the amounts that each participant chooses to contribute to the plan as well as the related matching contributions.

What Is the Purpose?

The ADP and ACP tests are designed to make sure that the average rates of employee contributions and the related company match are proportionate between the highly compensated employees (HCEs) and the non-HCEs. By tying what the HCEs can defer (and receive as a match) to the amounts the NHCEs contribute, there is a built-in incentive for companies to communicate the plan to employees, educate them on the advantages of saving, and encourage them to make/increase their contributions.

What Is the Allowable Difference?

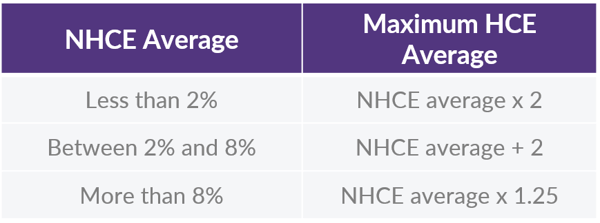

The spread to keep in mind is two percentage points; however, as we will describe below, there are several variations.

How Does the Test Work?

There are several steps involved in performing the ADP and ACP tests. Let’s start with the ADP test.

- Identify the testing group, which is comprised of all employees who are eligible for the plan. These are the participants.

- A common misunderstanding is that only those who are actually contributing are considered participants, but the rules actually treat anyone who is eligible as a participant, even if he or she chooses not to contribute.

- Divide the participants into two groups — the HCEs and the non-HCEs.

- Calculate the deferral rate for each participant by dividing his or her total salary deferrals (including both pre-tax and Roth) by his or her compensation.

- In participants who are age 50 or older have made catch-up contributions, those amounts are not counted in this calculation.

- Determine the average deferral rate for the HCE group and the NHCE group.

The plan passes the ADP test if the average for the HCE group is within a certain spread of the NCHE average. As a general rule, that spread is two percentage points, so for example, if the NHCE average is 3.50%, the HCE average cannot be more than 5.50%. But it can't be that easy...the maximum allowable spread is driven by the NHCE average as shown in the following chart:

Which Year to Use?

The ACP test works the same way except that instead of looking at employee deferrals, it looks at the related company matching contributions. So, the calculation of the match rate for each person is the matching contributions he or she receives divided by his or her compensation. The average match rates for the groups are compared. Again, as long as the HCE average is within the ranges in the chart as compared to the NHCE average, the ACP test passes.

When performing these tests, the NHCE average used to establish the HCE maximum can be taken from either the current year (the year being tested) or the prior year (the year immediately before the year being tested). Neither method is better or worse. The prior year method has the potential advantage of creating some predictability since the plan sponsor knows the HCE maximum early in the year. However, that predictability only helps if a sponsor is able to cap HCE deferrals so that they stay within the acceptable range.

The potential downside of prior year testing is that the beneficial results of increasing participation rates are not realized until a year later. In addition, a plan that uses the prior year testing method for the ACP test will find itself facing an automatic failure if it resumes a matching contribution after going for a year without one. This is because the NHCE average for the year when no match is made is 0%; therefore, the maximum match the HCEs can receive in the following year is 0%.

The plan document must specify which testing method will be used, and that method can be changed via a plan amendment adopted no later than the last day of the year being testing, e.g. no later than December 31, 2017, for the 2017 ADP/ACP test. In order to maintain some level of consistency, the IRS restricts the frequency of such changes. A plan can switch from prior year to current year at any time; however, a plan can only switch from current year to prior year once in any five-year period.

What Does This Mean?

When a plan fails the ADP/ACP test, correction is made by either refunding amounts to the HCEs or providing additional company contributions to NHCEs or some combination of the two. As long as the correction is made on a timely basis, there are no penalties. As a result, failing is not necessarily a negative event in that it confirms the HCEs have obtained the maximum benefit available to them based on the plan’s design.

If the goal is to reduce the chance of a failure in the first place, the company must either boost NHCE contributions (usually through additional education or maybe adjusting the company match) or limit the contributions made by HCEs.

Alternatively, the company could consider what is called a safe harbor 401(k) feature. While a full description is beyond the scope of this article, the gist is that by committing to make a minimum match or profit-sharing type contribution, the company can buy its way out of the ADP/ACP tests. That means HCEs can contribute as much as they want without worrying about a test failure.

A Few Miscellaneous Comments

The most stringent eligibility requirements a plan can impose are attainment of age 21 and completion of one year of service. If a plan is more generous, some shorter service employees who become eligible often choose not to contribute, which hurts the test results. In order to ensure companies are not penalized in this way, the IRS allows plans with more generous eligibility requirements to disregard for the ADP and ACP tests any employees who would not have been eligible under the stricter rules known as permissive disaggregation.

Some plans include “traditional” after-tax contributions by employees. This feature dates back several decades and is different from the Roth feature. Very few plans offer it, but for those that do, any such after-tax contributions must be added to the company match when performing the ACP test.

Additional information about the ADP and ACP tests can be found in Internal Revenue Code sections 401(k)(3) and 401(m)(2), respectively.