Facts

One of the participants in our 401(k) plan heard from a friend that it is possible to take money out of a plan while still employed. I’ve always heard that age 59 ½ is the rule of thumb as to when in-service distributions are allowed, but this participant is only in her mid-40s. She has about $100,000 in the plan: $65,000 in employee deferrals, $25,000 in safe harbor matching contributions, and $10,000 in profit sharing.

Question

Is it possible for a participant to withdraw some or all of his or her account while still employed prior to age 59 ½? If so, is there anything I should think about before amending our plan to allow this?

Answer

The short answer is, it depends.

First, we should note that this is not intended to address hardship withdrawals. They have their own special rules. We have more information regarding hardship withdrawals available here.

Ok, now back to “regular” in-service withdrawals. While it is possible for a participant to withdraw some or all of his or her account while still employed prior to the attainment of age 59 ½, the rules do have a few restrictions in place that will limit the accounts which are available.

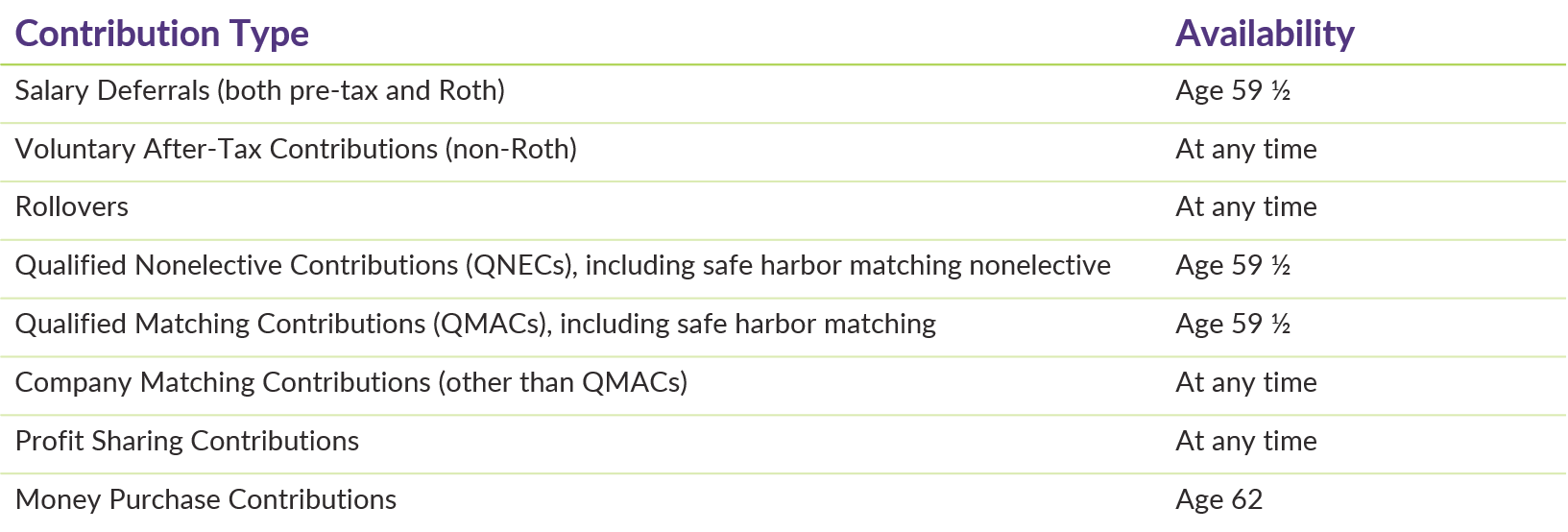

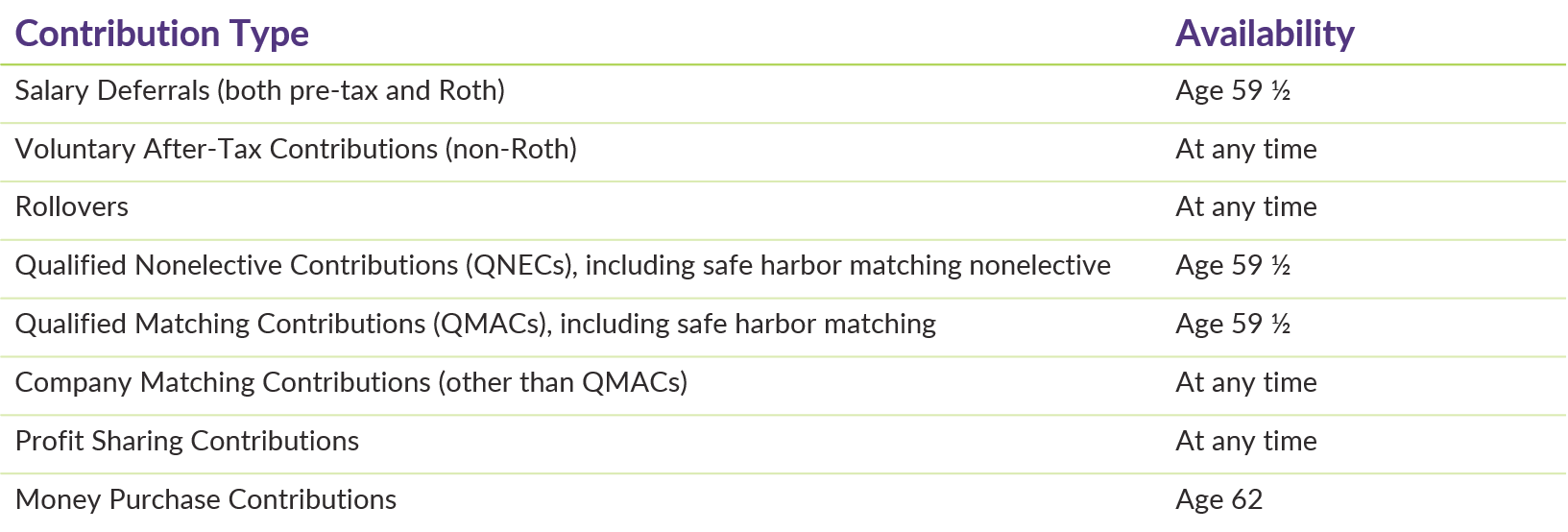

The chart below illustrates the contribution types and when they will be available for in-service withdrawal:

If we apply these rules to your fact pattern, we can see that this participant would only be allowed to withdraw from her $10,000 profit sharing account balance, because her deferral and safe harbor accounts cannot be made available prior to age 59 ½.

There are a few important caveats to keep in mind when considering offering in-service withdrawals prior to age 59 ½:

- While the law allows for it, you must be sure that your plan document permits it. If not, a plan amendment is required.

- The availability of in-service distributions is what is known as a protected benefit. That means once the provision is allowed at a specified age, you cannot remove it or increase the age at a later date.

- A participant is subject to a 10% early withdrawal penalty if s/he takes an in-service withdrawal prior to attainment of 59 ½.

If considering adding an in-service withdrawal provision or making other changes to your plan, reach out to DWC. We are happy to answer any questions. For more information on contribution types and distributions, please visit our Knowledge Center here and here.