Facts

We set up our company 401(k) plan soon after we started the business. At the time, being able to afford to make a match or profit sharing contribution seemed so distant as to not be worth thinking about. We were so focused on the only contributions being employee deferrals that we set the vesting schedule at 100% across the board.

The company is now doing really well, and we want to reward our employees by making a generous profit sharing contribution. The trick is that we would like to apply a lengthy vesting schedule to it as an incentive for our employees to stick around.

Question

Is it possible to change our plan’s vesting schedule? If so, what is the longest we can make someone wait to become fully vested? What other things should we consider?

Answer

The short answer is yes, you can change your plan’s vesting schedule. The longer answer is that based on your current schedule being set at 100%, any change can only be applied to new hires.

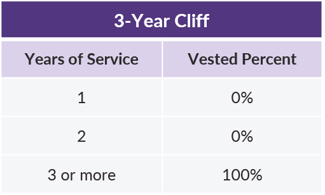

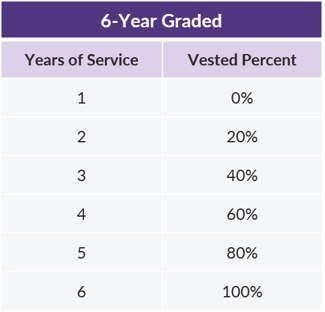

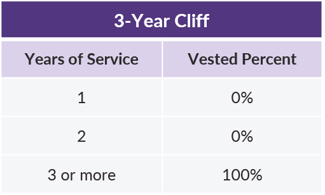

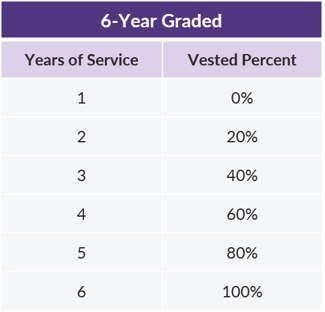

There are two main types of vesting schedules: cliff schedules and graded ones. The two most common are also the two most restrictive, as follows:

A plan can use a variation on one of these schedules as long as it is at least as generous as what is noted above at each step. For example, it would not work to use 0% for the first two years and then jump to 40% in the third year, but it would be acceptable to go with 20% each year from year one.

When changing a plan’s vesting schedule to one that is at least as generous as the current schedule at every step, a simple amendment is all that is necessary. However, if the new schedule is more restrictive at any point, there are additional detailed considerations with respect to those employees who are already eligible for the plan but are not yet fully vested.

Generally speaking, there are two options. You must either create a hybrid schedule that ensures their current vested percentage is never reduced, or you must give them the choice of staying with the current schedule or going on the new one.

In your situation, all participants are already fully vested, so it is not possible to apply a new schedule to them. However, you can amend your plan to apply a vesting schedule to all employees who become eligible in the future.

Other Considerations

The more moving parts that are added to any plan, the more complicated that plan is to maintain. Adding a second vesting schedule is no exception. Although it seems straight-forward enough, we have seen plenty of plans with multiple schedules that accidentally apply the new schedule to a longer-term employee or vice versa.

It can sound appealing to use the vesting schedule as an incentive for employees to stick around, but we often encourage clients who are considering such a change to take a look at the seniority, demographics and turnover of their current workforce. If most employees already stick around for close to that 6-year mark, adding a 6-year graded schedule might not service the intended purpose. And, if you already have a low turnover rate, applying a vesting schedule may be perceived as a take-away that could actually cause turnover to increase.

Another element to consider is that participants automatically become fully vested when they reach the plan’s stated normal retirement age (usually age 65). If a large concentration of your employees are already near that age, the addition of a vesting schedule isn’t likely to be of much help.

For more information on counting a participant’s length of service for vesting, please visit our Knowledge Center here.

Want a printable version of this article? Click here.