How Do I Calculate How Much Money is Available for a 401(k) Loan?

Facts

The participants in my company’s 401(k) plan are regularly inquiring about how much money they have available for a loan. When I report back the amount available to them, it’s not unusual for me to hear groans and exclamations from them that “this is my money” (particularly if they’re disappointed they aren’t able to access more). I know there are certain parameters related to participant loans set forth in the plan document, but it seems like there’s more to the magic formula that I’m just not able to explain to the participants.

Question

How do I calculate how much money a participant has available for a 401(k) loan?

Answer

You’re right; there are a number of factors beyond the plan document that determine how much a participant can withdraw in the form of a loan. This laundry list includes IRS limits, a participant’s vested balance, whether they currently have a loan, and whether they’ve had an outstanding loan within the last twelve months. Here is a quick look at each of these factors to help you determine how much a participant can borrow and why! Some of these limits can be a bit cumbersome, so bear with us. We will explain the limits and then provide a couple examples.

IRS Limits

The first limitation is the one set by the IRS. It provides that the maximum a participant can borrow from his or her plan account is 50% of the vested account balance, but no more than $50,000. If the participant has had a loan outstanding at any point in the last twelve months, that amount reduces the $50,000 cap.

Vested Balance

One common misunderstanding we see is which number to use when calculating the 50% limit – total account balance or vested account balance. The maximum is based on the participant’s vested account balance. If the participant has been with you for at least six years, he or she is already fully vested, which removes one step from the calculation. However, if a participant has fewer than six years of service, some portions of his or her account may not be fully vested (such as employer matching or profit sharing contributions). Those non-vested dollars are not taken into account when determining the maximum loan availability.

Prior Outstanding Loan Balance

The participant’s highest outstanding loan balance during the twelve-month-period ending on the day before the date a new loan is issued must be taken into account. That amount is applied to reduce the overall cap of $50,000, so it primarily comes into play only when a participant is seeking a fairly sizeable loan. This is true even if the previous loan has been paid in full.

However, that does not mean we can ignore it in the case of smaller loans. We’ve seen a number of situations in which a participant has taken out a $50,000 loan to meet a short-term need and repaid it just a few months later. If that same participant then requests another loan less than 12 months later, he or she would not be able to take it even if it is a small amount. Why? Because the overall limit of $50,000 is reduced by the highest balance the participant had in the trailing twelve months, which in this case, is also $50,000.

Current Outstanding Loan Balance

If the plan allows an employee to have more than one loan outstanding at a time, the limits are applied on an aggregate basis. In other words, the amount available for a new loan is reduced by any loan balances already outstanding.

Confused yet? If so, you’re not alone. This is confusing stuff. To translate it into something a little more useful, we’ve got a couple of examples for you.

Examples

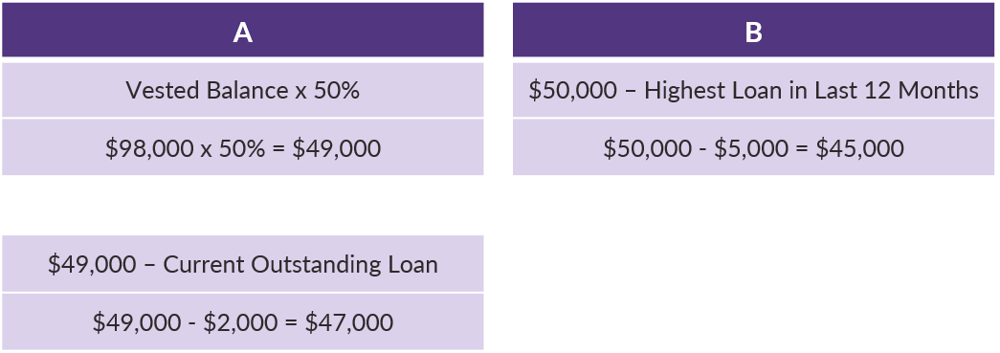

Example 1

Shaun has a vested balance of $98,000. He currently has an outstanding loan balance of $2,000, but the highest outstanding balance in the last twelve months was $5,000. How much can Shaun take as an additional loan.

The first thing to check is whether the plan allows a participant to have more than one loan at a time. If not, the rest is easy…the maximum available for a second loan is zero. Assuming the plan does permit a second loan, here is the calculation.

Now, we take the smaller of A and B, and that is the maximum Shaun can take as an additional loan. In this case, that is calculation B or $45,000.

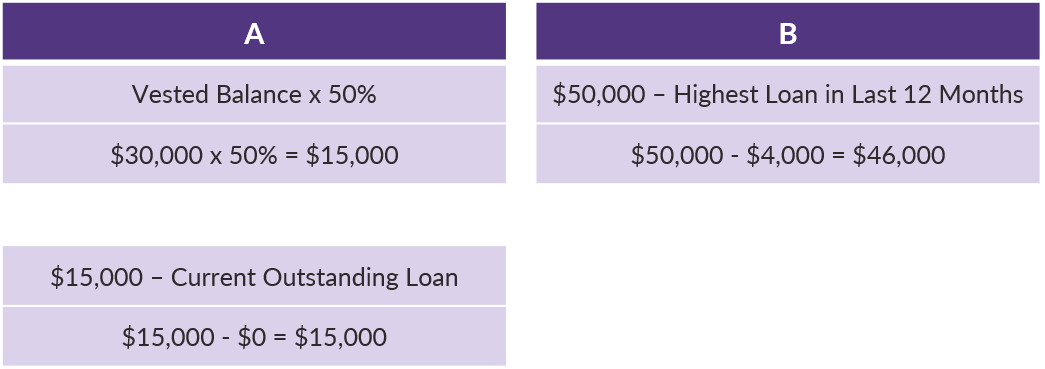

Example 2

Liz has a vested account balance of $30,000. Her previous loan is paid in full, but the highest outstanding balance in the last twelve months was $4,000.

Again, we take the smaller of A and B, and that is the maximum Liz can take in the form of a loan. In this case, that is calculation A or $15,000. In this situation, the highest outstanding balance in the last twelve months doesn’t really impact the calculation, because half of Liz’s account balance is already well below $50,000.

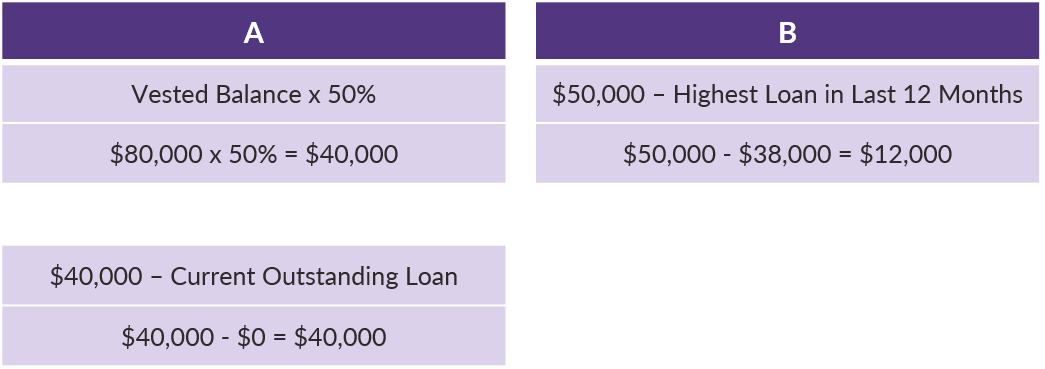

Example 3

Ed has a vested account balance of $80,000. He took out a substantial loan, paid it off quickly, but then realized that he needed the money for a longer period and now wants to take another loan. The highest outstanding balance of that prior loan in the last twelve months was $38,000.

Ed’s limit is $12,000 (B). Even though his previous loan is paid in full, the fact that he had such a large outstanding balance during the previous year limits the amount he is able to take at present.

You can use these tables as templates for calculating loan availability in almost any situation. They can also be a great tool for illustrating the “why” to plan participants.

A word of caution is in order. When it comes to refinancing an existing loan (if your plan even allows it), the calculations get much more convoluted and complex. They are another ballgame altogether. If a participant inquires about refinancing a loan, don’t hesitate to reach out to the friendly DWC team; we’re here to help! And who knows? Maybe we’ll tackle refinancing in a future QOTW.

For more information on participant loans, please visit our Knowledge Center here and here.

Want a printable version of this article? Click here.