Facts

When we set up our 401(k) plan, our partnership operated on a fiscal year that ran from July 1st to June 30th. We set the 401(k) plan year to line up with our company’s fiscal year. We recently changed our company’s fiscal year to follow the calendar year and didn’t think to notify our TPA to discuss the impact to the Plan. Now, they are asking for annual census information (including compensation) in order to prepare the profit sharing allocation and complete the required testing.

Question

For our W-2 employees, we know we need to report the compensation actually paid during the plan year. However, since our fiscal year and plan year are mis-matched, what compensation should we report for the partners?

Answer

So, fiscal years and plan years that don’t match and partnership compensation can be among the more confusing areas of retirement plans, and we’ve got both in one question! We’ll save the finer points of partnership compensation for another post and focus here on the fiscal year/plan year aspect.

Regulations provide that a partner's earned income becomes "currently available" as of the last day of the partnership's taxable year. In other words, his or her earned income is treated as “paid” on the last day of the employer’s taxable year even if he or she receives draws or guaranteed payments throughout the year. When it comes to the plan, a partner’s compensation for a given plan year is based on the company fiscal year that ends within that plan year.

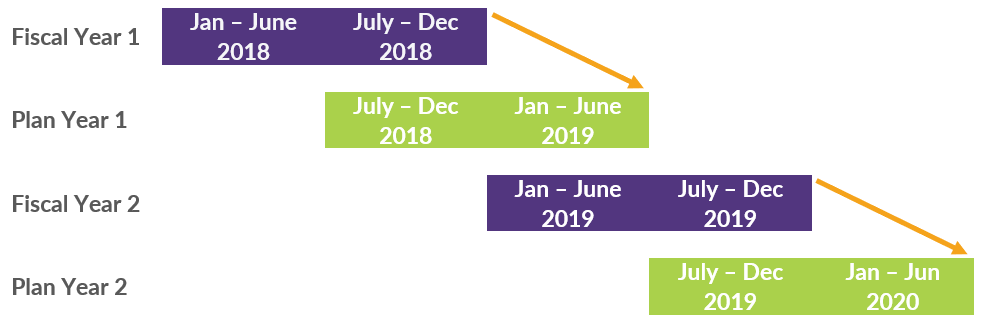

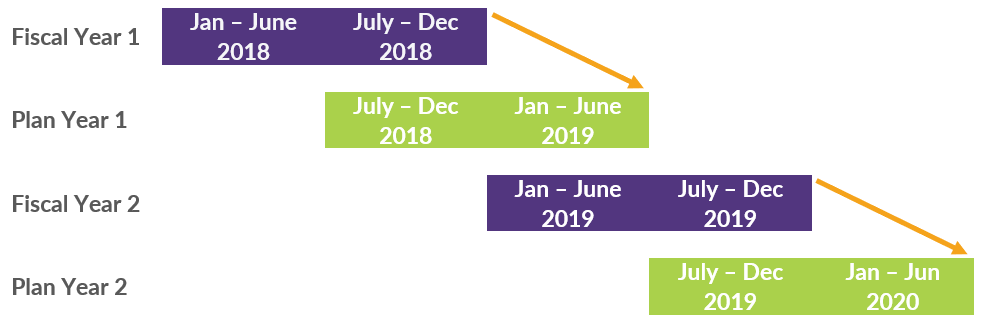

This concept is more easily explained using an example, and as goofy as it might sound (or maybe we’re just more visually oriented), it’s even easier still with a diagram. We’ll use the dates from your fact pattern.

Fiscal Year 1 is the one that ends during Plan Year 1, so the earned income for the partners as of December 31, 2018 (the last day of Fiscal Year 1) is what should be reported to your TPA to use for the plan year that ends on June 30, 2019 (Plan Year 1). Similarly, partner earned income for the fiscal year ended December 31, 2019 (Fiscal Year 2) is used for the plan year ended June 30, 2020 (Plan Year 2), and so on.

Seems simple enough, right? Let’s throw a bit of a wrench in the works. What if a W-2 employee became a partner on January 1, 2019? We know that the W-2 compensation paid to that person from July 1 – December 31, 2018 is considered for plan purposes, but what about the earned income while a partner from January 1 – June 30, 2019?

As counter-intuitive as the result might sound, it is right there in our handy dandy diagram. Since the 2019 earned income is not considered paid until December 31, 2019, it is disregarded for Plan Year 1 and is, instead, reported for Plan Year 2. That means the plan only counts this individual’s six months of W-2 pay for the plan year ended June 30, 2019.

Right about now, you are probably wondering, “Why not just change the plan year to line up with our new fiscal year?” You are reading our minds, and we will address that very question in a future QOTW.

For additional information about off-calendar plan years, including the impact to plan contribution and benefit limits, eligibility, and non-discrimination testing please visit our Knowledge Center here.

Want a printable version of this article? Click here.