Attribution of Ownership FAQs

Although the notion of company ownership seems relatively straight-forward, Congress was concerned that companies could use “creative” ownership structures to avoid certain laws. As a result, they created a series of complex rules that require the attribution of ownership from one person or entity to other people or entities in certain circumstances. As if one set of rules isn't enough, they actually created three different sets of rules, depending on the reason for the analysis.

Internal Revenue Code section 267(c)

- Used to determine those individuals who are prohibited from engaging in certain transactions involving plan assets.

Internal Revenue Code section 318

- Used to determine who is a highly compensated employee, key employee or a disqualified person in an Employee Stock Ownership Plan sponsored by Subchapter S Corporation. Also used to identify related companies that are part of an affiliated service group.

Internal Revenue Code section 1563

- Used to identify related companies that are part of a controlled group.

This FAQ focuses on the 318 and 1563 rules.

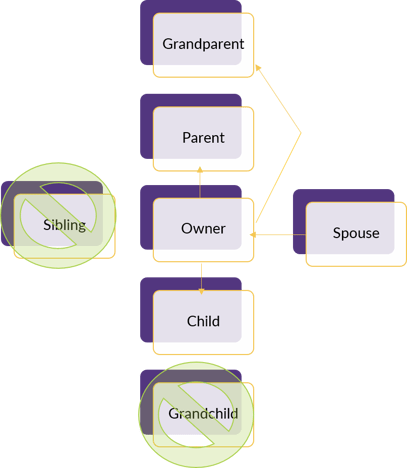

Attribution Among Family Members

I'm already overwhelmed. Can you give me the short version of these rules?

The general rule is that an individual’s ownership is attributed to his/her spouse, parents, children and grandparents (but not grandchildren).

That sounds pretty comprehensive. Are there any exceptions?

Yes. As seems to be the case with all retirement plan rules, there are some very important exceptions.

- There is no attribution from an individual to his or her grandchildren.

- There is no double attribution. In other words, a parent’s ownership would be attributed to a son, but it would not be re-attributed from the son to the son’s wife (the daughter-in-law of the owner).

Several other key exceptions are described throughout the remainder of this FAQ.

I don’t see brothers and sisters listed. Is there attribution between siblings?

No. There is no attribution between siblings.

Are same-gender marriages subject to the spousal attribution requirement?

Yes. In August 2013, the IRS issued Revenue Ruling 2013-17 which expressly provides that same-gender marriages are recognized for purposes of tax administration regardless of whether the state in which the couple currently lives or works permits same-gender marriages. The Department of Labor followed suit a month later with Technical Release 2013-04. In other words, as long as the marriage was legally valid at the time and in the state where it occurred, it is recognized for all employee benefit plan purposes.

How are the spousal attribution rules impacted when a couple is going through a divorce?

Attribution continues to apply until there is an actual divorce or a legal separation. In other words, if the spouses are estranged but not legally separated, they are still attributed each other’s ownership. However, see below regarding attribution between parents and children.

Also, it is important to keep in mind that for certain determinations, the rules look at those who are owners at any time in the current year or the immediately preceding year. In that case, although a divorce in the current year would break attribution prospectively, the former spouse would still be an owner for part of the year in which the divorce occurred and would, therefore, still be considered an owner for some purposes through the end of the year following the year of the divorce.

If I own a business and my spouse doesn’t work for the company, is s/he still attributed my ownership?

Under the section 318 rules, there is no exception to the spousal attribution requirement, so spouses are always attributed each other’s ownership under that section.

Under the section 1563 rules, however, attribution does not apply if all four of the following conditions are satisfied:

- The spouse does not hold direct ownership in the business;

- The spouse is not an employee and does not participate in the management of the business;

- The business’ income from passive investments does not exceed 50% of gross income for the year; and

- The owner’s interest is not subject to disposition restrictions in favor of his/her spouse and the couple’s minor children.

Shifting gears to parent/child attribution, do the rules apply when the child is an adult?

As in the previous question, it depends on which set of rules. The 318 rules always require attribution between parents and children, regardless of age.

Under 1563, on the other hand, attribution between parents and children over the age of 21 is dependent on other direct and attributed ownership held by each person. Specifically, a parent must own more than 50% of the business (directly or through other attribution) in order to be attributed the ownership of his/her children.

Consider the following examples:

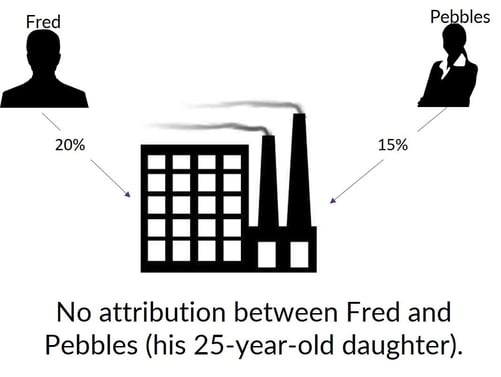

Fred owns 20% of Bedrock, Inc. Pebbles, his 25-year-old daughter owns 15% of the company. There is no attribution between Fred and Pebbles, because neither one already owns more than 50%.

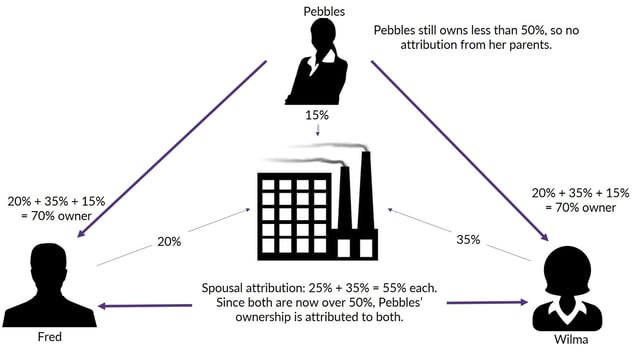

Now, assume that Fred’s wife Wilma owns 35% of the company. After applying spousal attribution, Fred and Wilma each own 55% of the company (Fred’s 20% + Wilma’s 35%). Since both now own more than 50%, they are both attributed Pebbles’ ownership as well, bringing their total direct plus attributed ownership to 70% each.

Is there always attribution between parents and children under the age of 21?

Yes, regardless of which set of rules are involved, there is always attribution between parents and children under the age of 21.

Attribution Between Businesses and Individuals

Are you saying that there is attribution between companies and people? How does that work?

Yes, and the mechanics vary depending on the set of rules (318 or 1563) and the type of business entities involved (C Corp, S Corp, etc.).

318 | When dealing with a C Corporation, anything that company owns is attributed to any individual who is at least a 50% shareholder of the company. Similarly, anything owned by a 50% (or greater) shareholder of a C corporation is deemed to be owned by the company.

In determining who meets the 50% threshold, other types of attribution are considered first. For example, assume that Barney and Betty are married and each own 25% of Slate, Inc. After applying spousal attribution, they each own 50% and are, in turn, attributed any ownership that Slate, Inc. may hold in other companies.

For entities other than C Corporations, the general rule is that anything owned by the company is attributed to the shareholders of the company in proportion to their interest.

1563 | The 1563 definition is more consistent across entity types. In a nutshell, anyone who owns at least 5% of a business is deemed to own a proportionate share of any interests held by that company. For example, assume Fred and Barney own 25% and 4%, respectively, of Bedrock, Inc. Bedrock owns 60% of Slate, Inc. Fred is deemed to own 15% of Slate (25% of 60%); however, because Barney owns less than 5% of Bedrock, there is no attribution of Slate ownership to him.

Also, under 1563, there is no attribution from an individual to a company.

For families, you mentioned that there isn't any double-attribution. Is that also true for company/individual attribution?

Not completely. Anything attributed from the company to an individual must be re-attributed; however, anything attributed from an individual to a company is not.

Are there other types of attribution?

Yes, there are, but you probably knew that before you asked. There are additional rules that relate to attribution from trusts and estates to their beneficiaries. If you can believe it, those rules are even more complex than the ones we have already described, so we haven’t even attempted to dissect them here.

I think I have a headache after reading all of this. What should I do to find out how all of this applies to me?

At DWC, we have many years of experience analyzing these types of issues. Given the complexity of the rules and the fact that regulations outside of the retirement plan context may come into play, it is sometimes advisable to work with a tax attorney who specializes in this area. We would be glad to discuss your situation with you and help you determine how best to proceed.