Facts

Our 401(k) plan failed the ADP test for the first time this year. We decided to correct the failure by making refunds to the highly compensated employees instead of making additional contributions for the other participants. However, when we got the actual refund amounts from our TPA, we were surprised to see that those HCEs with the highest deferral percentages are to receive smaller refund amounts.

Question

How are the corrective refunds determined and why don’t all HCEs share in them proportionately?

Answer

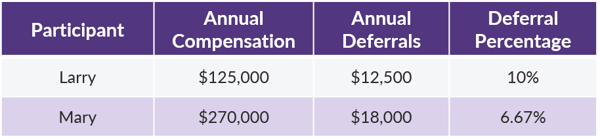

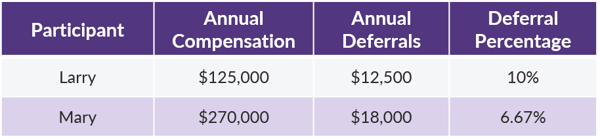

The best way to answer your questions is with some examples. Let’s take a look at Larry and Mary – both HCEs in a 401(k) plan that failed its ADP test.

Under the old rules, the refunds would have first been allocated to Larry since he has the larger deferral percentage. However, a few years ago Congress changed the rules so that the HCEs with the largest dollar amount are the first to receive refunds. The current rules include two steps.

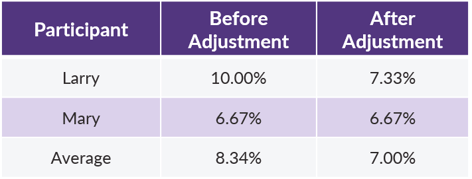

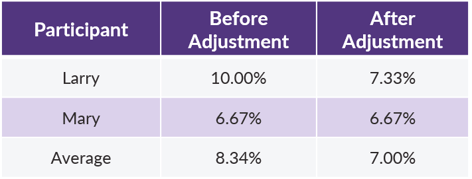

Step #1: Top Down Leveling by Percentage

Since the ADP test compares the average percentage deferred by the HCEs to that of the non-HCEs, the first step is to adjust those percentages so that they are within the allowable range of two percentage points. Let’s assume that the maximum HCE average that passes the test is 7%.

Since Mary’s deferral percent was already below the 7% maximum average, she is not adjusted during this first step.

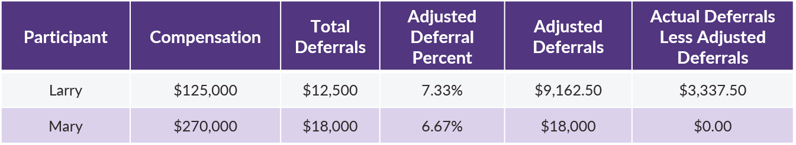

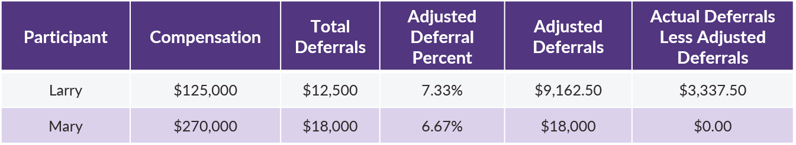

Step #2: Calculation of Total Dollars to Refund

Next, we multiply the adjusted deferral percentages from step #1 by each participant’s compensation to determine the total dollar amount to be refunded.

Now we know that the total amount to be refunded to correct the failed test is $3,337.50.

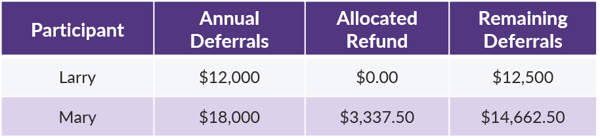

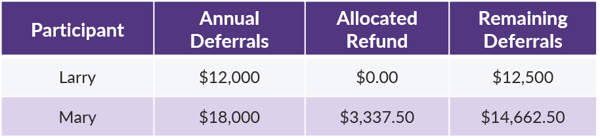

Step #3: Allocation of Total Refund Amount

Since the objective is for the refunds to go to those HCEs who deferred the largest dollar amounts, the total from step #2 is allocated to the HCEs, leveling down from largest deferral amount to smallest, until the total is completely allocated.

Since Mary’s remaining deferrals still exceed Larry’s even after the entire refund amount is allocated to her, Larry does not receive any refund at all even though his original deferral percentage was larger. As you can imagine, the more HCEs there are, the more the process gets convoluted with multiple iterations.

There are two quick items to note. First, if Mary is over the age of 50, the entire amount of her refund can be recharacterized as a catch-up contribution rather than paying it out to her. Second, any amount that will actually be refunded to an HCE must be adjusted to include a proportionate share of investment gains, and the refund amount is taxable to the HCE in the calendar year it is distributed.

For more information on the correcting an ADP test, please visit our Knowledge Center here and here.