Maximum Contributions: "Everybody Wants Some"

Let’s do a little recap. In the last two installments, we discussed what Robert is required to contribute (the Minimum) to his cash balance plan and what he should contribute (the Recommended). Now, we will talk about what he can contribute (the Maximum).

In the not-so-distant past, there was a time when the amount that a plan sponsor could contribute was very similar to, and in some instances equal to, the amount it was required to contribute. Thanks to the Pension Protection Act of 2006, defined benefit plan sponsors can now contribute to levels that bring assets up to 150% of the plan liabilities. Funding to the ultimate maximum level is not always a good idea; however, if used correctly, funding to a surplus can provide additional flexibility to an already flexible cash balance design.

As with most rules written by Congress, the Maximum rules have varying degrees of complexity. At its simplest, the Maximum contribution allows for funding to 150% of the plan’s liabilities (Funding Target) plus the benefit earned in the current year (Target Normal Cost). So, for the first year, the plan liabilities are typically $0. Therefore, the Maximum is 150% times $0 plus the Target Normal Cost (TNC). If you remember from the Minimum discussion, the IRS-mandated discount rates result in the TNC typically being less than the cash balance allocation.

Well, here comes one more level of complexity – for Maximum purposes, the IRS requires using a different set of discount rates, which creates a higher TNC (but still typically less than the cash balance allocation). There are also some load factors that increase the TNC and plan liabilities, but we won’t get into those here.

What does this mean for Robert?

By funding beyond the Recommended amount, Robert is able to defer additional taxes, which is great in a year when income is higher than expected. Plus, by contributing more than the Recommended, Robert has prefunded for benefits to be earned in future years.

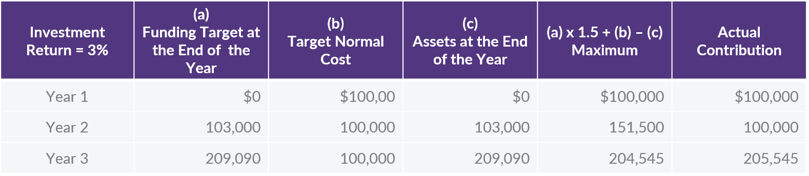

Let’s look at an example. For simplicity, we will assume that the discount rate, interest crediting rate and actual investment returns are all the same percentage.

For Year 1, the TNC is equal to the contribution credit ($100,000), and the Funding Target is $0. This creates a Maximum of $100,000, which is the same as the Recommended.

For Year 2, the Funding Target $103,000 ($100,000 + 3% interest credit), and the TNC is again $100,000. Here is how the match works out to determine the Maximum.

(Funding Target x 150%) + Target Normal Cost – End of Year Assets = Maximum Contribution

(103,000 x 150%) + $100,000 - $103,000 = $151,500

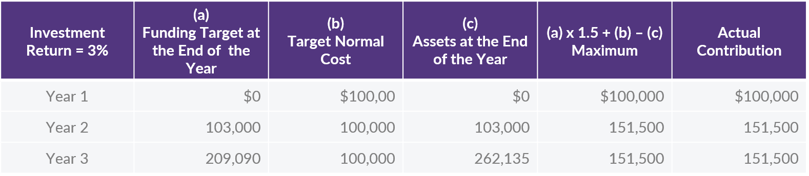

The ultimate Maximum for later years will depend on the contributions made in prior years. If Robert makes the Recommended Contribution in Years 1 and 2, then the Maximum in Year 3 is as follows:

If Robert contributes the Maximum in Year 2, the Maximum in Year 3 will be lower:

We will let you do the math, but if the Maximum is made for Years 4 and 5 as well, the assets at the end of Year 5 will be $746,370. That is a full $215,456 above the liabilities, and now the surplus is large enough to cover two years’ worth of benefits.

So, the question should be – “Why not keep going?” The answer is “because of the excise taxes.” Having a surplus is great…until it’s time to terminate the plan and the liabilities (i.e. future benefits) cannot be increased enough to “absorb” the surplus assets. Any unabsorbed surplus is subject to significant excise taxes. There are many reasons why a plan might need to be terminated, but the worst-case scenario is due to the death of the owner.

Avoiding excise taxes is the reason that having no more than one year’s worth of surplus is best. The reason that a single year works is because the surplus can be contributed after the end of the year. For example, assume for Year 3 that Robert makes the additional contribution on January 2nd of Year 4. The contribution is still deductible for Year 3, but if the owner dies on January 3rd of Year 4 (the day after making the additional contribution), the benefit for Year 4 can be applied early to absorb the surplus, meaning that the plan is no longer overfunded. If, instead, Robert deposits the contribution December 30th of Year 3 and then passes away on December 31st, there is no way to speed up the benefit from a future year.

The above example is for an owner-only plan. There are many scenarios where having a larger surplus is acceptable. For example, a spouse or child can continue the business and the plan should the owner die. Basically, any situation where the liabilities can continue to grow can eliminate the possibility of excise taxes.

A bit confused? Not to worry. The next installment will look at this funding design in more detail.

Want a printable version of this article to take with you? Click here.