MEP, PEP, or Stand Alone Plan, Which Is the Best Fit for Your Company?

Acronym Solutions

PEP mania appears to already be in the rearview mirror. The SECURE Act, the legislation that created the PEP, generated a lot of buzz back in December of 2019. Since then, details (or lack thereof) have led many industry service providers to conclude that PEPs have added a bunch of new bureaucracy with little to no real upside for anyone as compared to other solutions that have already been long available to plan sponsors. This is especially true from the fee perspective as seen in these excessive fee lawsuits against ADP Total Source and Pentegra as well as the Coca-Cola Bottlers’ Association.

Companies get a lot of sales calls from service providers, and the good, old-fashioned high fee and liability scare always makes for an effective door-opener. Nowadays, this song and dance seems to include the service provider’s Acronym of Choice as the preferred solution – acronyms like MEPs (multiple employer plans), PEPs (Pooled Employer Plans), GoPs (Groups of Plans). There is also the Exchange, which is a bit of a variation on these themes. It’s no wonder some business owners get fed up with the complexity of it all.

Our industry does not make it easy for companies to select service providers, let alone plan types! Fortunately, there are plenty of advisors, salespeople, and consultants that take the time to listen and educate companies on the key decisions. This allows plan sponsors to make the best plan design and service provider decisions.

Bring On The Acronyms

It is imperative for business owners to understand that it is impossible to fully relinquish their fiduciary responsibilities when sponsoring a retirement plan. This is true no matter what solution is being pitched! Plan sponsors can minimize their liability by hiring the best service providers and making sure they understand the service contracts they are signing, but they can never eliminate all liability related to the plan! If a salesperson pitches you zero liability along with little to no action on your part, our suggestion would be to RUN!

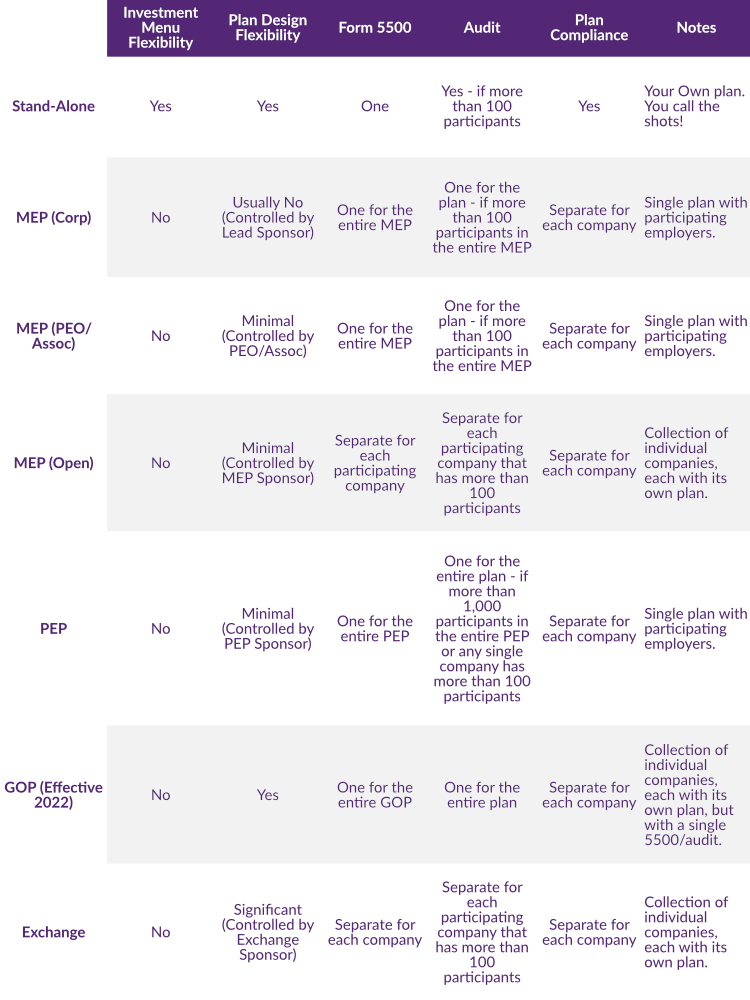

Let’s review some of the current alphabet soup of plan solutions:

- Stand-Alone Plan: Referred to as a single employer plan - the plan sponsor calls all the shots. They have full flexibility to design the plan and investment menu exactly how they want to best benefit the participants. They can select the service providers that are the best for them rather than being stuck with a package deal that might not all be the best fit. In short, the plan sponsor is in control and does not have to share anything with any other companies.

- Corporate Multiple Employer Plans (MEP): A corporate MEP is one plan covers several companies that have some overlapping ownership, but not quite enough to be officially related. The plan has a single, overriding plan document (established by the plan sponsor a/k/a lead employer), and each participating employer signs a participation agreement. Corporate MEPs typically do not allow any plan design flexibility among participating employers, and the same investment menu applies across the board.

- PEO & Association MEPs: In summer 2019, the Department of Labor published new regulations that officially permitted bona fide PEOs and Associations to sponsor MEPs for their client/member companies. To participate in a PEO MEP, a company must be a client of the PEO, and the PEO must provide substantial employment functions beyond just sponsoring the plan. Whereas, an Association Retirement Plan (or ARP) is limited to businesses that are members of the association, and the association must have at least one substantial business purpose other than providing benefits. In both cases, there is generally a single investment menu that applies across the board. And, while the PEO or association may allow some flexibility in plan design, adopting employers are often limited to just a few customizable features. Since the PEO or association controls the plan, they also get to decide which service providers to use.

- Open MEPs: An open MEP is not really a MEP at all; the DOL said as much in an Advisory Opinion back in 2012. Somewhat of a precursor to the PEP, so-called open MEPs are collections of separate stand-along plans that have nothing in common other than using the same service provider(s). Each company must obtain its own bond, file its own 5500, and obtain its own audit (if more then 100 participants). There is one investment menu for the entire plan, and while there may be some plan design flexibility, it’s usually pretty minimal.

- Pooled Employer Plans (PEPs): A PEP is a single plan with a single investment menu that a company (usually a financial services firm) establishes for its client companies to join as participating employers. The sponsor itself, however, does not necessarily participate in the plan. A PEP is similar to the open MEP except with additional regulatory requirements to address some of DOL’s concerns from 2012. There is a single 5500 for the entire plan, and the audit requirements can be more advantageous compared to a MEP or GOP. Compliance is handled separately for each employer, which typically means the PEP sponsor will limit plan design options to keep things streamlined.

- Groups of Plans (GOPs): Effective January 1, 2022, a GOP is a collection of individual, stand-alone plans that can file a single Form 5500 (and accompanying audit) as long as they all use the same investment menu, trustee, plan administrator, etc.

- Exchanges: An Exchange takes some of the best aspects of a stand-alone plan and an open MEP. Each company has its own plan, usually with significant design flexibility, but they take advantage of economies of scale on investment costs by sharing the same investment menu. Each adopting employer files its own 5500.

Audit Requirements for Large Plan Filers

A plan that has more than 100 participants on the first day of the plan year is required to hire an accountant to prepare an audit report that gets attached the Form 5500 when it is filed. That participant count includes everyone who is eligible for the plan (even if they are not actively contributing) as well as any former employees with remaining balances in the plan. For an in-depth review of the plans requiring an audit (including the 80/120 rule for small plan filers), read our QOTW from 2018.

PEPs offer a potential advantage over MEPs in this regard. While MEPs (and stand-alone plans) require an audit if there are more than 100 participants on the first day of the year, a PEP’s audit requirement kicks in when there are more than 1,000 participants on the first day of the year. There is one important catch here. If any single adopting employer in the PEP has more than 100 participants, that will trigger the audit requirement even if the PEP as a whole is still below 1,000.

Although this might sound like a big cost-saving opportunity, the reality doesn’t always work out that way. Plan audits are their own unique specialty, and the starting price from firms that know what they are doing usually start in the high 4 figures. A significant part of the audit methodology is to review the practices and procedures a company has in place to make sure the plan is operated properly – things like enrollment, payroll withholding, timely remittance of contributions, etc. With PEPs and MEPs, there isn’t just one company whose procedures need to be reviewed. If there are 100 participating employers in the PEP, that is potentially 100 sets of processes and procedures. In other words, it might be a single audit, but it’s going to cost a whole lot more than it would for a stand-alone plan. Even though the cost is spread among those participating employers (usually embedded in the overall plan fees), companies with fewer than 100 participants are now sharing in a cost they wouldn’t have to pay at all in a stand-alone plan.

There are a lot of articles that tout the benefit of MEPs, PEPs and GOPs only having to file a single Form 5500. This is really much ado about nothing. Once the rest of the annual compliance work is done, preparing a Form 5500 for a single employer plan with a standard investment menu takes very little time at all. Plus, there is the fact that MEPs and PEPs must include additional attachments that identify each of their adopting employers as well as the amount that each contributed to the plan for the year. So, the MEP/PEP/GOP files a single 5500 but it is more burdensome to prepare.

Some in the industry have proclaimed PEPs finally allow a true open-MEP-like solution. True, but what they are really saying is PEPs allow for a single Form 5500 if no audit is required. That is very little cost savings and even less of an overall benefit in exchange for the loss of flexibility!

Wrapping This Up

Let’s bring this post back together. PEPs aren’t dead, and they make a strong showing down the road. Their competition is and was steep as plan sponsors already have the other solutions we’ve discussed here that are just as cost-effective (if not more so) that allow you to work with premium service providers, which will provide greater liability protection in the long run than going with some sort of “just add water” version of a plan.

The traditional MEP sales pitch has now migrated to PEPs - low fees, low plan sponsor involvement, and low or no liability for the plan sponsor. Those lawsuits we mentioned above certainly suggest that pitch may be too good to be true. Just because out of pocket fees to the plan sponsor are low does not mean the participants are not paying excessive fees!

Exchanges are a compelling solution in that they are basically offering most of the benefits claimed by MEPs and PEPs but without making a mountain out of the 5500 molehill or severely limiting the flexibility that comes with a stand-alone plan. Plus, Exchanges can also include more affordable administrative fiduciary (3(16)) and investment management (3(38)) services.

PEPs are interesting in concept, but we need to see more details of the true benefit to the plan sponsor, certainly more than the overblown benefit of filing a single 5500. Liability protection is a good place to start. Although the sponsor of a PEP does assume much of that responsibility, the devil can be in the contractual details. For how long will the provider stand by its work if you discover a mistake a year or two down the road. Each participating company is still a fiduciary to its part of the overall plan. To what extent is there fiduciary liability for joining a group arrangement that requires participants to pay for an audit that wouldn’t be required as a stand-alone plan?

An acronym solution may not be the best fit for the plan sponsor but is a great fit for the service provider. This is why plan sponsors should focus first on hiring the service providers that are the best fit. More importantly, sponsors should not feel the pressure to run to an acronym solution when the single employer plan model is alive and thriving – thanks to technology and good old fashioned competition.