Facts

Our business is thinking of setting up a retirement plan. We’ve heard that there are new tax credits offered under the SECURE Act available to employers who set up new plans.

Question

What tax credits are available to us for setting up a new retirement plan for our employees? Are there any special requirements that apply?

Answer

Since we are talking about tax rules here, it would be asking way too much for this to be a simple answer, so we apologize ahead of time that this may be a bit more detailed than you were hoping.

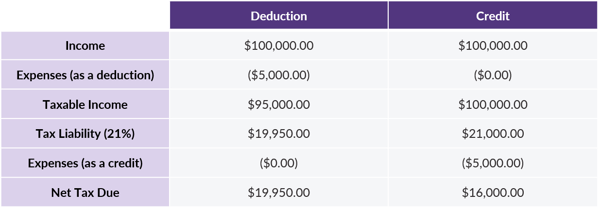

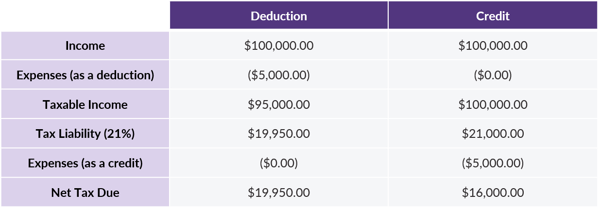

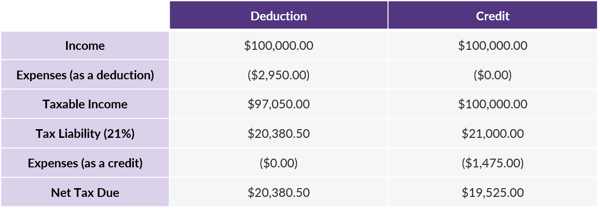

Before answering your specific question, a very short (we promise) dive into the tax weeds provides some context on the difference between tax deductions and tax credits. In short, a deduction reduces the income used to calculate the tax liability, while a credit directly reduces the tax liability itself.

The least “in the weeds” way to explain is via an example.

- Income = $100,000

- Tax rate = 21% (top corporate tax rate)

- Expenses = $5,000

So, a tax credit in this example saves $3,950 more in taxes than the same amount taken as a deduction. With that said, it is not uncommon for a tax credit to be limited to some portion of the expense amount that would otherwise be deductible as we will see in this case.

Plan-related expenses are typically tax deductible to the company, but half may qualify as tax credits instead, subject to certain limitations that we will describe below. That credit is available for the first three years a new plan is in place (the year it is first effective and each of the next two).

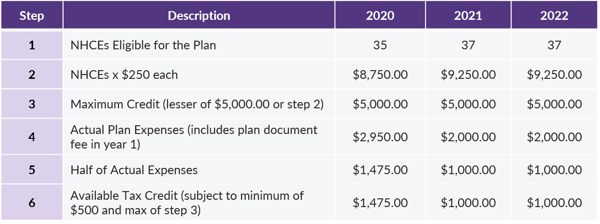

Basically, the credit is equal to 50% of eligible expenses, subject to a minimum credit of $500 and maximum credit of $250 per eligible non-highly compensated employee (capped at $5,000).

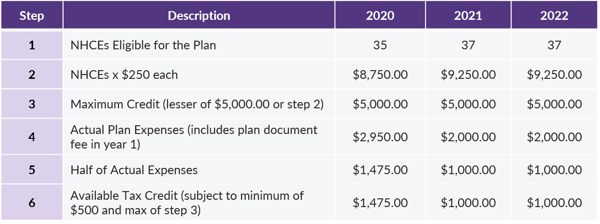

Yeah, we know…about as clear as mud. Let’s walk through the steps and then an example.

- Determine how many NHCEs are eligible for your plan

- Multiply that number by $250

- The result from step #2 is your maximum tax credit for the year, subject to an overall cap of $5,000

- Determine your actual eligible plan expenses for the year

- Multiply that number by 50%

- The result from step #5 is your tax credit for the year, subject to a minimum credit of $500 and a maximum credit equal to the result from step #3

Let’s look at an example.

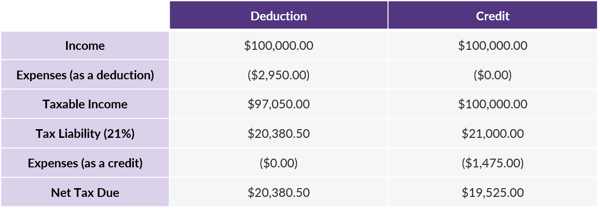

Now, let’s plug this into our deduction vs. credit chart from above for the 2020 tax year.

Even though the full amount of expense can be claimed as a deduction but only half as a credit, the credit still results in a tax savings of over $850 more than the deduction.

To claim the credit, you must meet the following requirements:

- The expenses must be related to plan establishment, administration, and/or participant education,

- You cannot have sponsored a plan at any time in the immediately preceding three years,

- At least one plan participant must be a non-highly compensated employee; and,

- You must have 100 or fewer employees with at least $5,000 in compensation in the preceding year.

It is important to note that you cannot claim both a deduction and a credit for the same expenses, and the expenses must be paid by the company rather than from plan assets or revenue sharing.

Since each tax situation is different, we always recommend that you consult your tax advisor for specific projections and tax savings related to deducting plan expenses vs. taking advantage of available tax credits.

For more information, please visit our SECURE Act Resource Page.

Want a printable version of this article? Click here.