What is a Short Plan Year and What Does It Mean for My Deferrals?

Facts

Our company operates on a calendar tax year, but our 401(k) plan runs on a fiscal year ending each June 30th. It is a real hassle to manage two different year-ends, so we asked our TPA about aligning the two. They said we could amend the plan to make that happen, but there is also something about it creating a short year which would require us to go through year-end compliance testing twice during the transition.

Question

What, exactly, is a short plan year? And, if I have to work through the full battery of year end administrative and compliance tasks, does that mean I can defer up to the maximum for each of those two periods?

Answer

Well, I am sure everyone is on the edge of their seats for the answer to the second part of your question. That also happens to be the shorter answer, so we will start there. The annual deferral limit ($19,000 + $6,000 in catch up contributions for those over age 50, based on 2019 limits) goes with the individual taxpayer and not the plan. That means that each individual can only defer a total of $19,000 (or $25,000 if over age 50) during a calendar year regardless of how many 401(k) and/or 403(b) plans he or she might be eligible for and no matter how many full or partial plan years are involved. Sorry, not the answer you were hoping for, we know.

That brings us back to the first question. What is a short plan year? The “what” is not quite as helpful as the “how” or the “why”? A short plan year is any plan year in which there are fewer than 12 months. See, pretty obvious but not terribly helpful, so let’s look at how and why short plan years are created.

Company-sponsored retirement plans are generally required to operate on a 12-month plan year. From time-to-time, however, there are circumstances that cause a given year to be truncated. Here are several examples:

- Change of Plan Year This is your situation, and changes of plan years are usually for exactly the reason you suggested. There is a mismatch between the company’s tax year and the plan year, which creates additional work and confusion. You are changing your plan year end from June 30th to December 31st. Assuming that is taking place in 2019, you have one plan year that ends on June 30, 2019, and a plan amendment that creates a short plan year end at December 31, 2019, so that you can move forward on a calendar year basis.

- New Plan Setup When a company decides to setup new plan at some point other than the first day of the year, a short plan year can occur. However, this is less common, because it is still possible to use the first the day of the year as the plan’s initial effective date even if it is not actually being setup until sometime after that. There are some things to watch out for when doing so, but those are details for another day.

- Plan Discontinuance Whether a company terminates its plan or merges it into another plan, a discontinuance that is effective on any day other than the last day of the year will create a short plan year.

Regardless of the reason for a short plan year, when one occurs, the plan must go through the full year-end process (compliance testing, Form 5500, etc.) even though the year in review is less than 12 months. For a plan startup or discontinuance, it doesn’t seem like that big of a deal, because the company would have to go through that process for its first year or final year anyway. However, when there is a change of plan year, the transition can seem like a bigger headache.

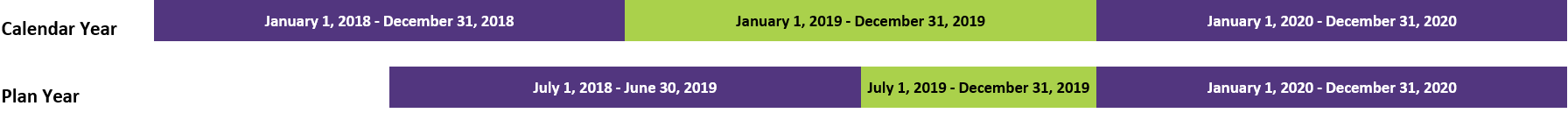

Going back to your situation, since the short plan year is triggered by an amendment that changes the year, you end up with an “extra” year that must be tested, etc.:

- July 1, 2018 – June 30, 2019

- July 1, 2019 – December 31, 2019

- January 1, 2020 – December 31, 2020

There are a number of idiosyncrasies when it comes to working through a short plan year, which can involve everything from eligibility and vesting to determining who is highly compensated. To make matters even more confusing, most of the contribution limits are pro-rated, but one key limit is not. We will cover these nuances in more detail in future QOTWs, but we thought we would mention it here because it ties back to your question about deferrals, because – you guessed it – that is a limit that is not pro-rated.

Let’s use your situation to walk through how this works.

As your plan is currently written, you have a plan year that ended June 30, 2019, and the next one will end on June 30, 2020.

In this scenario, a participant could only defer up to the maximum of $19,000 (or $25,000 if over age 50) during calendar year 2019 even though there are portions of two different plan years involved.

Here is what it looks like with your proposed amendment:

It works the same way. There are still two plan years (one partial and one short) that overlap the 2019 calendar year. A participant in this scenario would still only be permitted to defer up to a total of $19,000/$25,000 for calendar 2019.

We know this is a lot to take in from what started as a simple question. Even though you aren’t able to double-up on deferrals thanks to the short plan year, you rest easy knowing that these extra details are a one-time challenge that goes away once you are moving forward on a calendar year basis. You can rest even easier knowing that you can count on the experts here at DWC to guide you through it all.

Want a printable version of this article? Click here.