What Is a True-Up Matching Contribution?

Facts

Our 401(k) plan provides for a matching contribution of 50% of the first 6% deferred by each participant (for a maximum match of 3% of pay per year). We deposit the matching contributions to the plan each pay period at the same time we deposit employee deferrals. After year-end for the last couple of years, our TPA has informed us that we have to make “true-up” matching contributions, sometimes for employees who are no longer with us.

Question

What is a true-up matching contribution and why do we have to make them? Is there any way to avoid them in the future?

Answer

True-up contributions typically come into play when the plan document specifies that the match must be determined on an annualized basis, but the plan sponsor actually calculates and deposits the match each pay period (or monthly, quarterly, etc.) More specifically, they occur when a participant defers above the maximum match threshold (6% in this case) for some pay periods and below it in other periods.

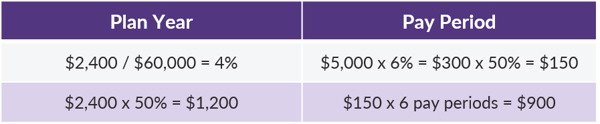

A quick illustration should help to clarify:

With a pay period match, the match formula is applied to the deferral and compensation amounts from each separate pay period. In the first half of the year in our example, the participant was deferring 8%. Since only deferrals up to 6% are matched, the participant does not receive a match on any deferrals above that limit (between 6% and 8% of pay). The activity in one pay period does not impact the calculation of the match in other pay periods. The annual match amount is simply the sum of the matching contributions calculated separately for each individual pay period.

When calculating the match over the full plan year, however, each participant’s annual deferral amount is divided by his or her annual compensation to determine the annual deferral rate. Here, the participant deferred 8% for half the year and 0% for the other half, yielding an annual deferral rate of 4%. Unlike the per period situation where a portion of deferrals are not matched (because they exceed the formula), here the entire amount deferred is eligible for match because it falls below the top end of the formula.

It is fairly common for companies to calculate and deposit their matching contributions each pay period. Payroll providers can typically perform the calculation, and it helps to smooth out cash flow to make 26 smaller deposits over time rather than one big deposit after year-end. Just because it is common doesn’t mean that we can ignore the plan document. So, going back to our above participant, if the plan provides for a plan year match but it is calculated and deposited each pay period, the participant will be entitled to a $300 true-up match after the end of the year (the difference between the $1,200 plan year match per the plan document and the $900 that was funded throughout the year.

While it can be tempting to amend your plan to change from plan year to pay period to eliminate true-ups, it is a good idea to first focus on who receives the majority of the true-up contributions. We see quite a few situations in which a business owner or officer will defer 100% out of the first or last few paychecks of each year rather than spreading them evenly across the entire year. In those situations, a pay period match means no true-up, but it is a senior member of the company who loses out on receiving the full match. Sticking with a plan year match assures the owner/officer receives as much match as possible.

It is also worth noting that regardless of the time frame used to calculate the match, the ACP test is run using annual compensation. In our example, that means the pay period method yields a match rate of 1.5%, while the plan year method yields 2%. For highly compensated employees, the higher the rate, the worse the test results. The reverse is true for non-HCEs. So, if your ACP test has been right on the pass/fail line, it would be a good idea to run some projections before changing how your match is calculated. You wouldn’t want to save a few bucks in true-up contributions only to make your plan fail the ACP test.

For more information on plan contribution types, please visit our Knowledge Center here.