Rules for Mandatory Cash-Outs

There are several important reasons to be aware of former employees with remaining balances in the plan.

- Recordkeeping and other plan-related fees are often based on the number of participants with account balances.

- Many formal plan disclosures must be provided to former employees until they take a full distribution from the plan.

- Plans with more than 100 participants on the first day of the year are generally required to file a Form 5500 as a large plan filer, which requires hiring an accounting firm to audit the plan’s financial statements. The participant count includes inactive participants with remaining balances. Please note, for plans that have never required an audit, this requirement kicks in at 120 participants.

- For participants who terminated five or more years ago, it is necessary to track and forfeit non-vested balances.

- The plan is required to submit Form 8955-SSA to the IRS to report terminated participants who maintain balances in the plan for more than a year.

However, one of the most important reasons is that many plans include a provision requiring former employees with vested balances below a certain threshold to be forced to take their money out of the plan. These force-out payments are referred to by a number of different names – involuntary distributions, mandatory cash-outs, etc. Regardless of the name that is used, plan sponsors must give participants that fall below the threshold the opportunity to voluntarily withdraw their balances. If the participants do not take action, the plan sponsor must distribute their balances.

Our plan includes a force-out provision, is this optional?

No. Plan sponsors are required to periodically review balances of former employees and process mandatory distributions that fall below the applicable threshold.

What does “periodically” mean in relation to the force-out distribution?

This is somewhat ambiguous and has been interpreted to mean everything from continually to at least once each year. Based on a strict technical reading of the rules, it could be interpreted that involuntary cash-outs must be initiated at whatever frequency the plan allows voluntary distributions.

So for example, if a plan allows for immediate distribution on termination of employment (as most 401(k) plans do), a mandatory distribution should be initiated immediately after a participant with a small balance terminates.

Most plans also include the magic words “as soon as administratively possible.” Many providers interpret that language to allow for less frequent cash-outs, such as quarterly or annually.

Regardless of the frequency selected, plan sponsors should be consistent with their timing at each interval. For example, if cash-outs are processed quarterly, they should be processed at generally the same time each quarter.

What are the cash-out thresholds that apply?

Each plan has the option to set its own thresholds within certain parameters. The regulations allow the cash-out threshold to be set as high as $5,000 and they also allow a plan sponsor to elect no cash-outs at all. However, the threshold selected must be written into the plan document and followed.

There is one additional factor to consider. Plans that set the threshold at more than $1,000 must process the cash-outs in two different ways depending on the amount in question. Vested balances between $1,000 and $5,000 must be rolled over into an IRA established on behalf of the former employee. Amounts below $1,000 can be cashed-out via a check to the participant.

Throughout the rest of this FAQ, references to dollar amounts are intended to refer to vested account balances, not necessarily total account balances.

What is the incentive for plan sponsors to leverage the $1,000 - $5,000 IRA rollover requirement as opposed to simply selecting the $1,000 threshold and cashing people out?

When these rules were first put into place in 2005, many sponsors chose to do just that. However, as the marketplace has evolved, many recordkeepers and investment providers now have products and processes in place to facilitate these types of automatic IRA rollovers. For sponsors that wish to “streamline” their plans by eliminating as many former employee balances as possible, using the higher limit is an effective way to accomplish that.

Automatic rollover service providers can typically be found by researching retirement benefit plan services.

If automatic rollovers are easier, can we apply that option to all balances below the threshold?

Yes, as long as your plan document includes the necessary wording, it is possible to automatically roll all balances below $5,000 into an IRA for the participant rather than issuing cash distributions.

What if a former employee rolled a large amount into our plan but has only a small amount from contributions we have made?

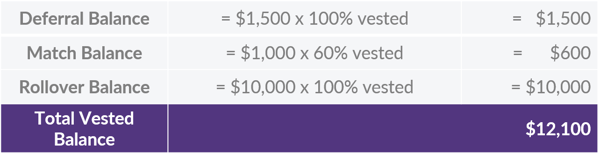

Plans that use the maximum limit of $5,000 can elect (via the plan document, of course) to disregard rollover balances when determining who is subject to cash-out. Consider this example:

It appears this participant is well over the limit and cannot be cashed out. However, if the plan document provides for the exclusion of rollovers, the vested balance for this purpose is only $2,100, which means the participant must be forced out. This includes the entire $12,100.

Do I have to notify participants before cashing them out?

Yes.

Before processing an involuntary distribution, the plan sponsor must give a former participant at least 30 days advance notice to elect to take a cash distribution or rollover into an IRA or new plan of his/her choice.

The notice must include the standard distribution disclosures (such as the special tax notice), explain what will happen if the participant does not make an election, i.e. cash out or auto rollover, and inform the participant of the deadline for making an election.

Do you have any sample letters we could use to notify former employees?

You can download sample letters in Word format by clicking this link. These samples assume a force-out limit of $5,000, so you may need to make adjustments if your plan uses a different limit.

What about really small balances? Are these account balances subject to the force out provisions?

There are a couple of exceptions for balances of less than $200. First are those that fall below the distribution fee that would normally be charged to their accounts. It is common practice for these amounts to be paid to the recordkeeper as an account-processing fee to eliminate the account.

Accounts that exceed the distribution fee but are less than $200 can be cashed out without prior notification. These balances should be automatically distributed via check; however, there is no mandatory tax withholding.