Can We Add a Safe Harbor Provision While Maintaining Flexibility in Contribution Costs?

Facts

We currently sponsor a 401(k) plan and have been debating adding a safe harbor provision for 2021. While the idea of buying our way out of the ADP/ACP tests is appealing, we’re nervous about the idea of a mandatory contribution. If cash flow isn’t what we expect in a given year, we don’t want to be stuck with expensive contributions.

Question

Are there any options for us to add a safe harbor provision but maintain some flexibility to control contribution costs?

Answer

Absolutely! You are not alone in wanting the testing assurances that come with a safe harbor plan while preserving as much flexibility as possible. One of the easiest ways to have the best of both worlds is to exclude highly compensated employees (HCE) from the required safe harbor contribution. Notice the emphasis on the word “required.”

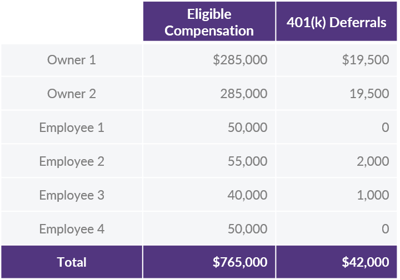

Now, before you start wondering why anyone would ever go that route, let’s work through some examples to see how this plays out, using the sample below.

Based on this information, the plan would fail the ADP test (requiring refunds to the two owners); and adding a safe harbor provision would solve that problem and allow the owners to continue contributing the maximum. There are, of course, three different options a company can choose for the required safe harbor contribution:

- Nonelective contribution: 3% of pay to all those eligible for the plan

- Matching contribution: 100% of the first 3% deferred plus 50% of the next 2% deferred (yields a maximum match of 4% of pay)

- QACA matching contribution: 100% of the first 1% deferred plus 50% of the next 5% deferred (yields a maximum match of 3.5% of pay)

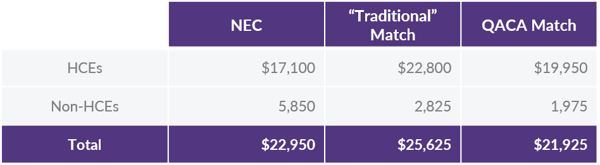

If we apply these options to our sample employee data, the annually required safe harbor contributions work out as follows:

Under all three scenarios, the majority of the total required company contribution is for the benefit of the Owners (i.e., the HCEs). Since that is likely one of the reasons for setting up the plan in the first plan, it isn’t necessarily a bad thing…except for the concern you mentioned at the beginning.

What about years when cash is tight? Because the safe harbor rules are meant to ensure a certain minimum level of contribution for the non-HCEs, you can design your plan so that contributions are required for the non-HCEs but optional for the HCEs. Presto! You have a safe harbor plan with the flexibility to reduce your contribution cost by more than 70% in any given year should you need to do so.

First things first…you must ensure that your plan document specifically provides that only non-HCEs share in the required safe harbor contribution. From there, many plan documents have language built in, granting you the discretion to also make the contribution for HCEs in years you wish to do so. However, if utilizing a plan document that doesn’t automatically give you that option, you can still usually achieve the same or similar flexibility by utilizing the plan’s discretionary profit sharing feature to provide a contribution equal to what the safe harbor contribution would have been.

If the year has already started by the time you realize that some belt-tightening might be in order, have no fear. The IRS has clarified that it is possible to amend mid-year to carve HCEs out of a safe harbor contribution. They must be given 30-days advance notice and the opportunity to change their deferral elections. Even though you must fund the contribution through the effective date of the change, amending your plan in this way can give you some extra financial breathing room if needed.

We appreciate that the safe harbor plans are usually put in place to help HCEs maximize contributions, so it’s important this group doesn’t lose that benefit when cash flow allows. However, it is the safe harbor contributions made on behalf of the HCEs that are most expensive. This simple change to the plan document can create flexibility and cost-savings without complicating overall plan administration.

With IRS-required Cycle 3 plan document restatements coming up, that could be a great time to explore this type of change or any others that can give you greater flexibility to adapt your plan as business needs evolve. Not sure what to look for? No problem! Your DWC team is here to help. We’re happy to take a look at your plan and discuss ways to make sure it is working for you.

Want a printable version of this article? Click here.