Forgot to (Timely) Execute a Document Restatement? There's a Fix for That!

You probably know that establishing a qualified retirement plan requires the formal adoption of a written, legal plan document. And, if you’ve had a plan in place for any amount of time, you’ve most likely also been required to adopt a handful of mandatory amendments along the way.

Periodically, there are changes in laws and regulations that require updates to plan document language. Sometimes, those updates require the plan document to be completely re-written (a process known as restating the document), but oftentimes, the update takes the form of a simple “tack-on” amendment. Good intentions aside, a plan sponsor may occasionally miss a required restatement or fail to timely execute an amendment, causing the plan document to become non-compliant. If the IRS selects a plan for audit, having a plan document that is out-of-date can result in expensive fines.

While it may sound tempting to simply back-date a document, its not surprising to hear that the IRS is not fond of that approach. In fact, we have seen them pursue charges of criminal fraud against a plan sponsor for back-dating an amendment. Luckily, the IRS offers up an approved method for getting things back on track via its correction program, the Employee Plans Compliance Resolution System (EPCRS)!

Operation Outsource Production and Supplies sponsors the OOPS 401(k) Plan. Here’s what you need to know about this plan:

- It was originally effective on January 1, 2009

- OOPS signed the initial plan document on December 1, 2008

- The plan operates on a calendar year

- OOPS switched third party administrators in 2018

As part of the onboarding process, the new TPA requested copies of the current plan documents and amendments. OOPS provided the following:

- Copy of the initial plan document, executed on December 1, 2008

- Amendment for the Heroes Earnings Assistance and Relief Tax Act of 2008 (HEART)

- Amendment for Worker, Retiree, and Employer Recovery Act of 2008 (WRERA)

After several follow-up requests, OOPS confirmed that it did not have any additional plan documents or amendments.

Over the years, the IRS has implemented several sets of rules related to the deadlines for mandatory plan amendments and restatements. Sometimes, the amendment deadline is built into the language of the new law or regulation, but the deadline is usually tied to the due date of the plan sponsor’s tax return for the year the change was effective.

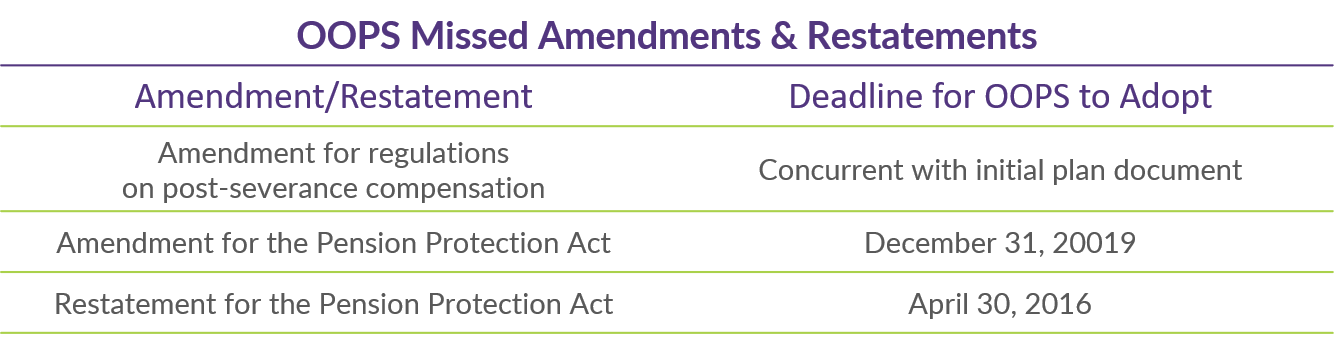

Based on the above facts, OOPS was missing the following required amendments and restatements:

Since OOPS either did not timely adopt these amendments and restatements or simply cannot locate the timely signed copies, the plan documents are non-compliant and must be corrected.

For more details regarding required plan document amendments and restatements, please see our Knowledge Center.

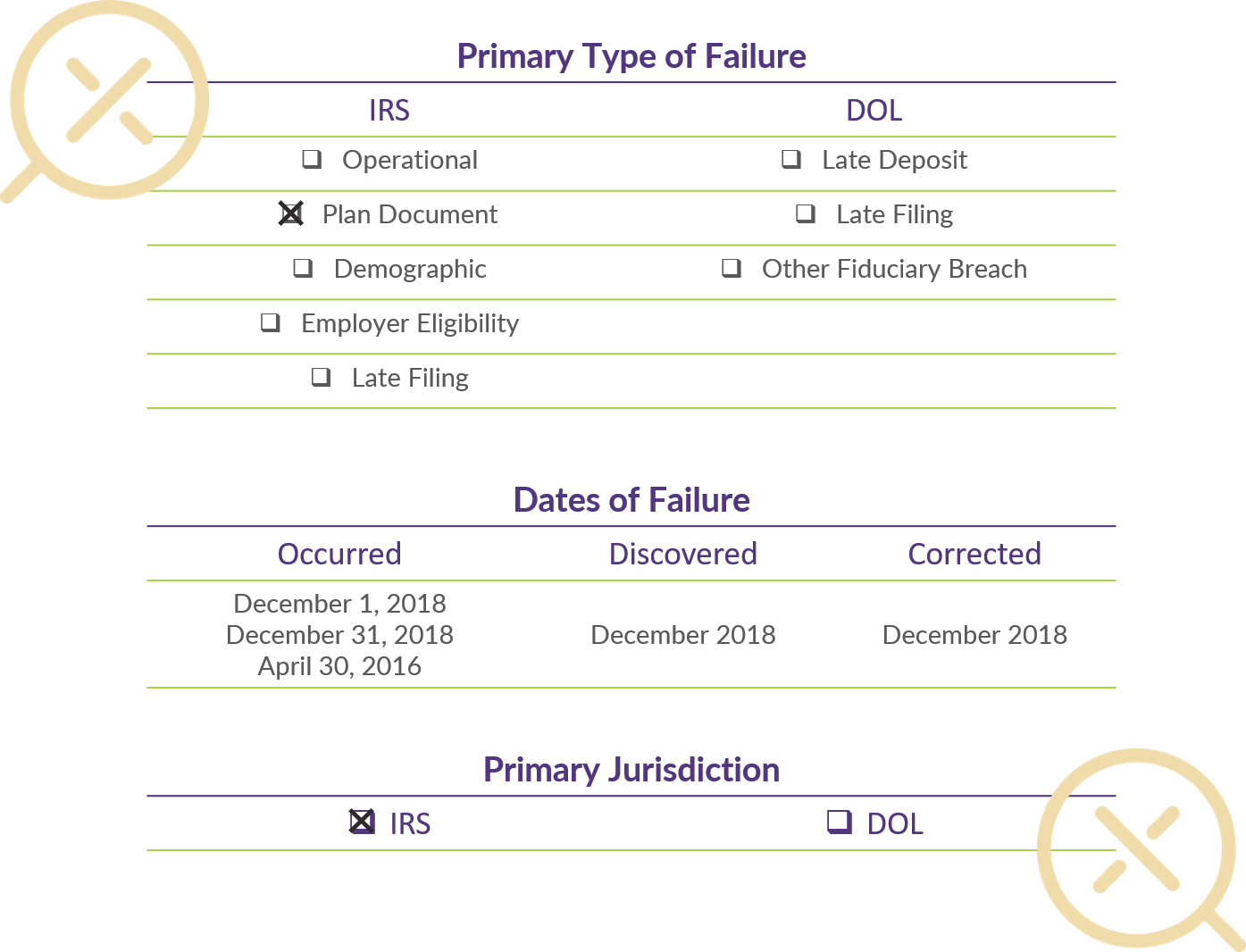

Error Details

Note: To correct plan document failures under EPCRS, a plan sponsor must utilize VCP (with very few exceptions). What’s the difference between SCP and VCP? Click here. How do you navigate this alphabet soup? We’ve got you covered here.

As with all plan corrections, the basic premise is to put the plan, and its participants, back in the position they would have been in had the error not occurred. IRS Revenue Procedure 2018-52 outlines the appropriate correction for this type of error, which is actually pretty easy. The plan sponsor simply adopts the missed documents and amendments, using a current signature date but with effective dates that are retroactive, as applicable based on the changes in question. Although the IRS does permit some failures to be self-corrected, plan document failures must be formally submitted to the IRS for their approval via the Voluntary Compliance Program (VCP) component of EPCRS. Fortunately, non-amender failures are typically “rubber stamp” approvals.

Document Preparation & Execution

First things first – it’s time to get the plan document up to date. In addition to bringing the plan document language current with the missed amendments and restatement, it is also important to review plan operations to ensure they align with what will be written into the new documents and amendments. For example, the OOPS 401(k) Plan effective January 1, 2009 did not allow for participant loans, but OOPS approved loans to participants starting in 2017. As part of this correction process, the restated plan document should reflect the loan provision with an effective date of January 1, 2017.

Are we good to go with the VCP submission now?

Not quite; as part of this document correction there are a few related items for OOPS to consider. The first is a deeper dive into past plan document preparation and execution. Sure, the mere thought of this may make you shudder, but the IRS reserves the right to review prior plan documents as part of its review and approval of the current corrections. It would be most unfortunate if such a review revealed failures other than the ones already identified. Since there is not really a limit on the number of failures being corrected on a single VCP application, it makes sense to find as many of those skeletons in the closet as possible and include them.

Ready, Set, Submit!

Once all plan documents have been reviewed, updated and executed, the VCP application can be prepared. As part of this process, OOPS must file a series of forms and other supporting documentation as part of the application. They must also pay a user fee to the IRS, based on the total amount of plan assets reflected on the most-recent Form 5500 filing. One more plug for tackling all corrections in a single VCP submission: this IRS fee does not change based on the number of corrections included in the submission. A single submission that addresses multiple corrections is a more efficient and cost-effective means to bringing the plan in compliance. Otherwise, you might find yourself saying, “Oops, I did it again.”

Then, it’s just a matter of waiting. Even though non-amender failures usually get a rubber-stamp approval, the process can still take several months to complete. Fortunately, most of that time is just playing the waiting game; there is no additional action required while the application works its way through the IRS review and approval process. If the IRS has any questions about the submission, they will send those questions in writing (via snail mail) and provide lead time for a response.

If you have a plan that has missed a restatement or amendment, DWC is ready to assist with the correction process.

Bad things happen to good plans. If you've experienced a failure like this, or are combating other issues, DWC is here to help with Plan Correction Services to address any "oops" moments in your plan.

RELATED RESOURCES