How to "Push It" (But Not Too Much) by Prefunding Cash Balance Plans

Thanks to the last few CB Corner entries, we now know that our plan sponsor Robert Smith, Inc. has a wide range of options when it comes to making contributions to its cash balance plan.

- The minimum keeps Robert out of trouble with the IRS and avoids a 10% excise tax);

- The recommended keeps the assets in line with the liabilities; and

- The maximum creates the highest tax deduction and provides a safety net for funding future years, but there can be too much of a good thing if the plan is overfunded at the time of termination.

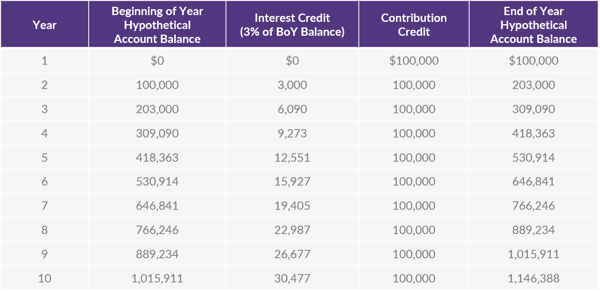

Today we are going to discuss a funding policy that uses the Maximum Contribution rules to create a situation where a plan sponsor always has at least one year of a “contribution holiday” and will never be in a situation to have to pay the surplus penalty. Before we start, let’s look at our expected cash balance projection for Robert:

A great advantage of a cash balance plan over a traditional defined benefit plan is the predictability of the amount of assets needed at retirement. Robert (the owner and only employee of Robert Smith, Inc.) is 52 years old, starts a cash balance plan with a contribution credit of $100,000 per year, and plans to retire in 10 years. With a fixed interest crediting rate of 3% per year, we know his account balance at age 62 will be $1,146,388. That means that regardless of the actual return on assets, the final lump sum amount is $1,146,388.

If company contributions exceed $100,000 per year and/or the investment return is more than 3% per year, the plan will be overfunded when Robert retires. Since Robert did not design his plan to provide the maximum benefit (which is approximately $3 million for a 62-year-old), he can amend the plan to increase the benefit to absorb/eliminate the excess. Keep in mind that excess assets that revert to the plan sponsor at plan termination are very bad – like 50% excise tax bad -and should always be avoided.

In most cases, companies adopt cash balance plans for tax deferral purposes, so they typically implement conservative investment policies to keep deductible contributions as high as possible and mitigate volatility. As we walk through the determination of an optimal funding policy, we will assume that the actual annual investment return is 3%, unless otherwise stated.

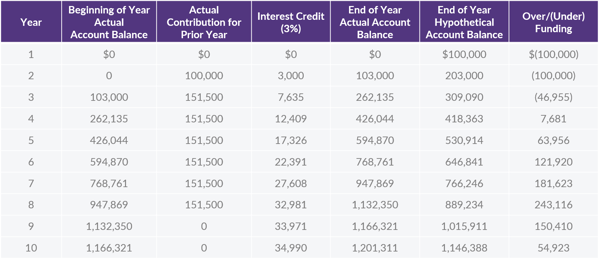

Even though we know Robert can get much more than $1.1 million out of his cash balance plan, let’s assume for this example that $1,146,388 is the maximum. We know one way to get there is to contribute $100,000 per year; however, we also know that the Maximum Contribution can be as follows:

So, if Robert contributes the maximum for years two through seven, he is done contributing. With assets at just over $1 million at that point, the annual interest credit over the three remaining years until he pays out the lump sum (after year 10) will push total assets to $1,202,311, which is almost $55,000 more than plan liabilities.

To reiterate, creating a surplus is great for that occasional off year when it is difficult to make a contribution. However, too much surplus can lead to high excise taxes. (Sorry to sound like a broken record, but it’s that important!) Therefore, always maintaining a surplus equal to the next year’s contribution is the ideal scenario.

Notice that after the Year 3 contribution is made (early in Year 4), the assets are $413,635 ($262,135 +151,500) and the liabilities are just over $309,000. That means the surplus just covers the contribution credit for the next year.

Here is the most important part of this funding policy. Notice in the table above that we show the contribution for each year actually being made early in the subsequent year, e.g. Year 1 contribution made early in Year 2, etc.

The contribution creating the surplus should not be made until after the end of Year 3. The first $50,000 could be deposited before year-end, but the remaining $100,000 should wait until no earlier than the first day of Year 4. If the full $151,500 is deposited in Year 3 and Robert dies before the end of Year 3, that creates a surplus, which leads to the 50% excise tax when the plan is terminated. If the additional contribution is deposited on the first day of Year 4 and Robert dies the next day, then we can amend the plan to speed up the accrual of the $100,000 contribution credit for the year (after working 1 hour of service) and the liabilities catch up to the assets. Presto chango, the surplus and accompanying excise tax are both eliminated.

You may be wondering, “Why terminate the plan?” Well, if there is no way to continue the company, there are no future benefits to be earned. This is less of an issue if there are additional owners or family members in the business, as the surplus can be used to fund their future accruals. But the company must be able to continue or be sold.

We have spent that last couple of months going over all the contribution scenarios for the Robert Smith, Inc. Cash Balance Plan. Next time we will provide an overview of some of the more administrative requirements (think government filings and so forth) that apply before we turn out attention to the fun that comes along when Robert hires his first employee who becomes eligible for the plan.

Want a printable version of this article to take with you? Click here.