Facts

My company started a brand new 401(k) plan last year. We didn’t start the plan until July 1, and since we operate on the calendar year, our first “year” of the plan will only be the six-month period from the start date through December 31, 2019. Now, our TPA is asking us for the compensation we paid to each of our employees during the lookback year (whatever that is) so that they can determine who are our highly compensated employees.

Question

What and when is a lookback year? Does it include a full twelve months even though our initial plan year is only six months? What if the company is also new and hasn’t been in existence for that long? What am I supposed to supply my TPA?

Answer

Welcome to the next installment in our series of all things short plan year! The fact that we have a series of questions on this topic should be reassuring in that you are definitely not the only person to have them. Before we answer yours, a quick review is in order.

Highly Compensated Employees

Since your questions are in the context of identifying your plan’s HCEs for testing purposes, let’s take a quick review of what an HCE is. Basically, an HCE is anyone who meets the ownership test or the compensation test:

- Ownership Test: Any employee who owns more than 5% of the company sponsoring the plan (or a related company) during the current year or the preceding year is an HCE. This includes both direct ownership and attributed ownership.

- Compensation Test: Any employee who received gross compensation (from the company) of more than $120,000 in the immediately preceding year is an HCE. That is the 2018 limit, which is increased for inflation in $5,000 increments. The limits for 2019 and 2020 are $125,000 and $130,000, respectively.

In your specific questions, we are looking at the compensation test.

Lookback Year

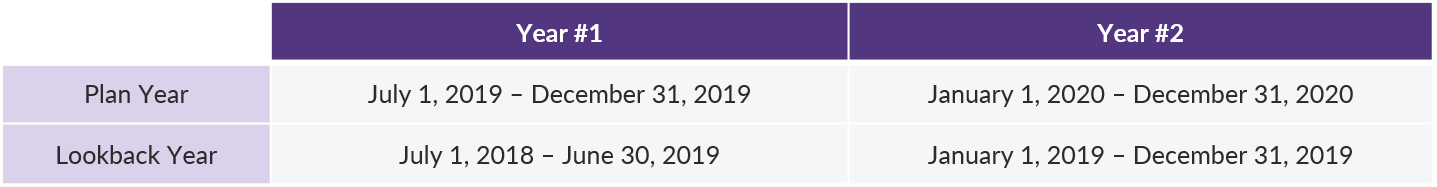

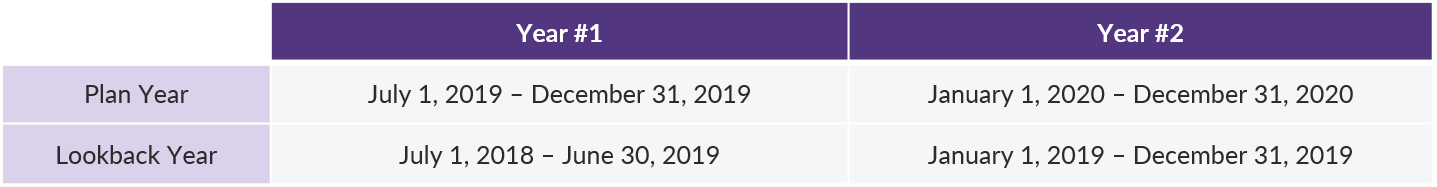

Since we made several references above to the immediately preceding year, you may be starting to guess what the lookback year might be. In short, it is the full twelve-month period that immediately precedes the start of the current plan year. Let’s apply that to your situation.

So, for the first year of your plan (July 1 – December 31, 2019), you would need to provide your TPA with the actual gross compensation paid to each of your employees from the July 1, 2018 through June 30, 2019. That means anyone who was paid more than $120,000 during that time frame is an HCE for your plan during that initial year.

For your second plan year (January 1 – December 31, 2020), the lookback year will be the 2019 calendar year. Yep, that means the first half of 2019 overlaps both the first and second lookback years. Any employees who received total compensation of more than $125,000 from you in 2019 will be an HCE for 2020.

New Company

Is there an exception if our company is also brand new and did not exist for a full twelve months before we started our plan? There sure is!

We pretty much always start with the day before the first day of the plan year in question and count backwards. If the company started fewer than twelve months before that date, then the first lookback year only extends back to the date the company was established.

You didn’t provide us with the exact date, so we will assume the company launched on February 1, 2019. That makes your initial lookback year the five-month period from February 1 through June 30, 2019, and that is the time frame you would use to gather data for your TPA.

Aren’t you glad you asked? If course, if you have any additional questions about short plan years, give us a call. Otherwise, stay tuned in the coming weeks for more short plan year fun!

For more information about short plan years and highly compensated employees, please visit our Knowledge Center here and here.

Want a printable version of this article? Click here.