Can We Offer Additional Matching Contributions Without Losing our Safe Harbor Status?

Facts

We currently sponsor a 401(k) plan for our company. While we certainly want to be able to provide meaningful benefits to the owners, our goal is to encourage all our employees to save more for their retirement, and to reward those who do. We were failing our annual testing, so we implemented a safe harbor provision to provide a matching contribution to all eligible participants who defer. This is a great start toward our benefit goals, but we’d like to make additional matching contributions.

Question

Is there any way to provide additional company contributions to the plan while still maintaining its safe harbor status?

Answer

We don’t get to say this very often, but the answer is a resounding yes…with a few additional rules to keep in mind. Don’t worry, this isn’t one of those “too good to be true” scenarios. There are always a few restrictions, but there are still some pretty cool options to enhance your plan design.

Safe Harbor Review

Let’s quickly review some of the perks you enjoy from the safe harbor provisions in your plan. First and foremost is that the plan gets a free pass on the annually required ADP/ACP test. In addition, assuming the eligibility for 401(k) deferrals and safe harbor matching contributions are the same, the plan is deemed to satisfy the top heavy requirements for the year.

This means all highly compensated employees can maximize their 401(k) deferrals and receive the maximum safe harbor matching contributions without the need for testing or concern about making refunds or corrective contributions. It also means even if the key employees hold more than 60% of plan assets, the otherwise required top heavy minimum contribution (generally 3% of pay to all eligible participants) does not apply. These safe harbor benefits are pretty valuable and, if lost, can be costly in a number of ways.

Profit Sharing Contributions

We know you specifically asked about matching contributions, but we thought we would throw this in for good measure. It is possible for you to make profit sharing contributions to the plan without being required to contribute the same amount to each participant. This is referred to as the new comparability method for allocating the contribution. While it does offer some flexibility and retains the free pass on the ADP/ACP test, it does come at a price:

- You are generally required to contribute for most (if not all) eligible participants, even if they are not deferring for themselves.

- The plan loses its free pass on the top-heavy determination.

- There are additional testing requirements that apply to the profit sharing allocation.

If this sounds intriguing, you can read more here and here. Now that we’ve at least covered that base, let’s get back to some options involving matching contributions.

Matching Contributions

There are generally two types of additional matching contributions that come into play, both of which can be subject to a vesting schedule (unlike the safe harbor match which must be fully vested).

- Discretionary Match: This type of match allows the company to decide from one year to the next whether it will make a match and, if so, what the formula will be. The plan document must specifically allow for this type of match, but there aren’t too many other parameters that must be listed in advance.

- Fixed Match: This type of match is not discretionary and requires the plan document to spell out all the parameters, including the exact formula that will be used to calculate the match. A fixed match can only be changed/reduced on a prospective basis and requires a formal plan amendment to do so.

Layer a Discretionary Match

So, how do you use these additional matching contributions and still preserve the plan’s safe harbor status? The first option is to layer a discretionary match on top of the safe harbor match. There are a few important limitations to keep in mind here.

- The formula cannot consider employee deferrals that exceed 6% of compensation;

- No participant can receive a discretionary match that exceeds 4% of his/her pay; and,

- Participants cannot be required to satisfy any other conditions to receive the match.

One other word of caution…this match is in addition to the safe harbor match and begins with the first dollar a participant defers into the plan. This match does not start with the deferrals where the safe harbor match stops.

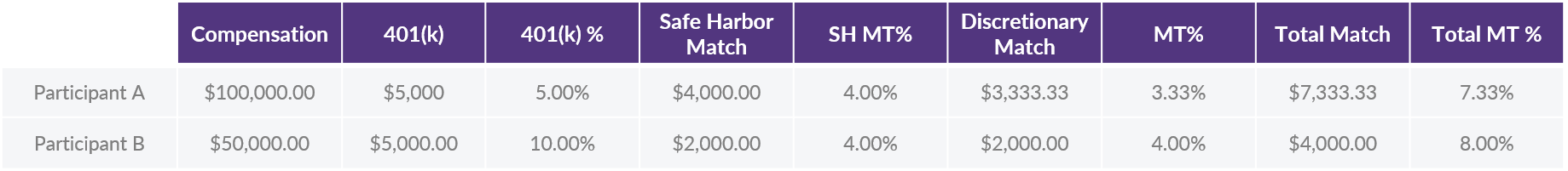

Let’s take a look at what all this means in practice. The maximum formula that remains within he above parameters is 66.67% of the first 6% deferred by each participant (66.67% x 6% = 4%).

By adding this second match, it’s entirely possible that a participant could receive total matching contributions that exceed the amount he or she deferred.

Layer a Fixed Match

Maybe the discretionary match gets you closer to your goals but not quite to the finish line. It may sound too good to be true, but there’s actually a way to maximize owner contributions into the plan and still preserve all the safe harbor benefits.

By making a fixed match the third layer, you can maximize the owner(s) while still only providing matching contributions to those who are deferring. As with the discretionary match, there can be no allocation conditions, and the formula cannot be based on deferrals that exceed 6% of pay. However, the total amount of the total match is not capped at 4%.

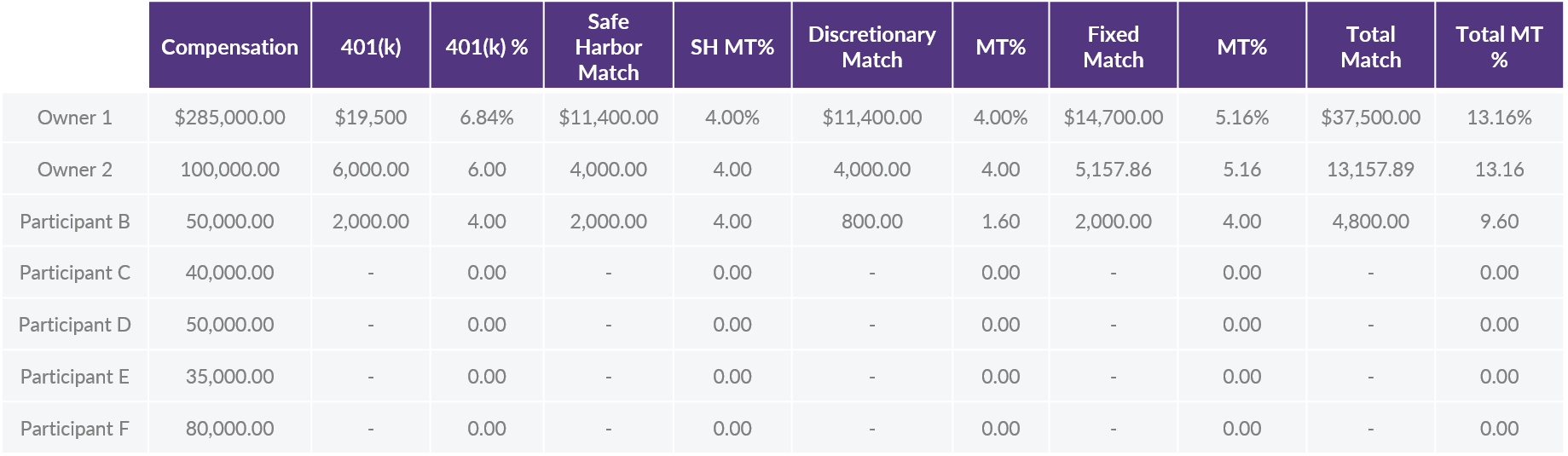

The table below illustrates this concept, using a fixed match formula of 86% of the first 6% deferred by each participant.

As we mentioned above, this third layer is a true “fixed” match that you must write into the plan document. Unlike the discretionary match that is flexible (and optional) from year to year, you can only change this match formula (via amendment) on a prospective basis from plan year to plan year.

There Must be a Catch

There can be. This triple match scenario can be a powerful way to reward participants who are actively contributing and maximize owners, all while preserving your plan’s safe harbor status. In the scenario above, the owners get a total of $50,657.89 in employer contributions at a cost of only $4,800.00 in contributions to their employees. This means the owners get more than 91% of the total company contributions while avoiding any nondiscrimination testing.

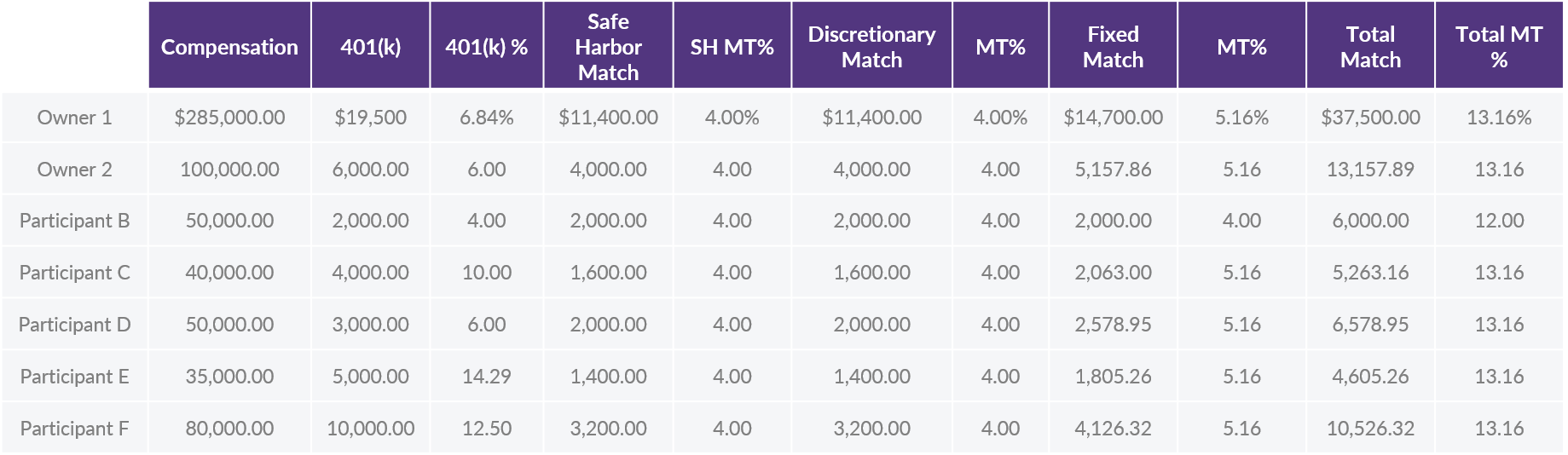

The potential monkey wrench is that adding two more layers of matching contributions can cause participants to increase contributions more than expected. Of course, workers saving more for retirement is a good thing, but with this design, it can also cause the overall cost of the company match to skyrocket. Let’s tweak the example above to illustrate.

With the increased deferral rates, the total employer contributions are now $83,631.58 with $32,973.69 going to non-owner participants. The owners still receive more than 60% of the total, but this illustrates how quickly the matching contributions (up to 13.16% in this scenario) can add up as additional participants begin/increase their deferrals. If the company demographics suggest this is a likelihood, a new comparability profit sharing contribution could provide a more cost-effective option after all.

The takeaway here is that there are usually plenty of options to get to your desired retirement plan goals. Each plan design has its own varying degree of complexity, flexibility, and cost. The best way to determine the right fit for your firm is to run the numbers and discuss the results. If you’d like to take a look at what kind of creative solutions might be available to enhance your benefits package, let DWC help you explore!

Want a printable version of this article? Click here.