Feeling Defeated in the Battle of Participant Loans? We've Got a Fix for That.

While not quite as ominous as a battle with the Night King, dealing with participant loans in retirement plans can be a daunting challenge for plan sponsors. Because of Congress’ concerns about protecting plan assets from improper use by participants and plan sponsors alike, the loan rules are strict and unforgiving.

In fact, they are kind of like gravity in that regard. If you step off the top of a large wall, you will fall. There is no gray area or subjectivity; gravity takes over without any prompting. The same is true of the loan rules; a single misstep, no matter how inconsequential it might seem, causes a loan to become defective even if no one notices right away. And, continuing with business as usual for a defective loan can lead to additional problems. It is actually not all that uncommon for a single loan oversight to multiply into numerous errors that require multiple strategies to reclaim the iron throne of compliance.

Waiting for Winter (WFW) sponsors a 401(k) Plan. Here’s what you need to know about this plan:

- Originally effective on January 1, 2017,

- Operates on a calendar year,

- Allows in-service withdrawals at age 59 1/2,

- Does not allow participant loans, and

- Does not cover highly compensated employees.

On April 10, 2018, J. Snow reached out to the plan trustees to inquire about accessing a portion of his account balance. Mr. Snow was 50 years old and not yet eligible for an in-service withdrawal based on age; however, being a critical part of WFW, the trustees were eager to find a way to assist. They recalled a conversation from the plan setup a year before about allowing loans from their plan, so they suggested that as an option to J. On April 17, 2018, WFW processed a loan for $12,000 to be paid back over the next 5 years.

When the TPA was preparing the compliance work and reconciliations for the 2018 plan year, they noticed the withdrawal but saw no corresponding payments coming back in to the participant’s account.

In this scenario, the plan trustees are probably feeling as though no good deed goes unpunished. In an effort to accommodate the needs of a participant, while seemingly harming none, the plan has violated several rules that now require correction.

The first is the failure to follow the terms of the legal plan document. Even though the law allows participant loans, that is an optional provision that must be reflected in the plan document for any plan choosing to offer the feature. Since the WFW plan does not permit loans, Snow’s transaction creates an operational error that requires a fix. The second? Participants must repay loans at least quarterly according to a level amortization schedule. In this case, the loan has gone more than a year without any payment at all.

Assuming the rules governing participant loans must be super complex? Let’s just say you’re not wrong. We’ve got you covered with 20 questions, participant loan style, right here.

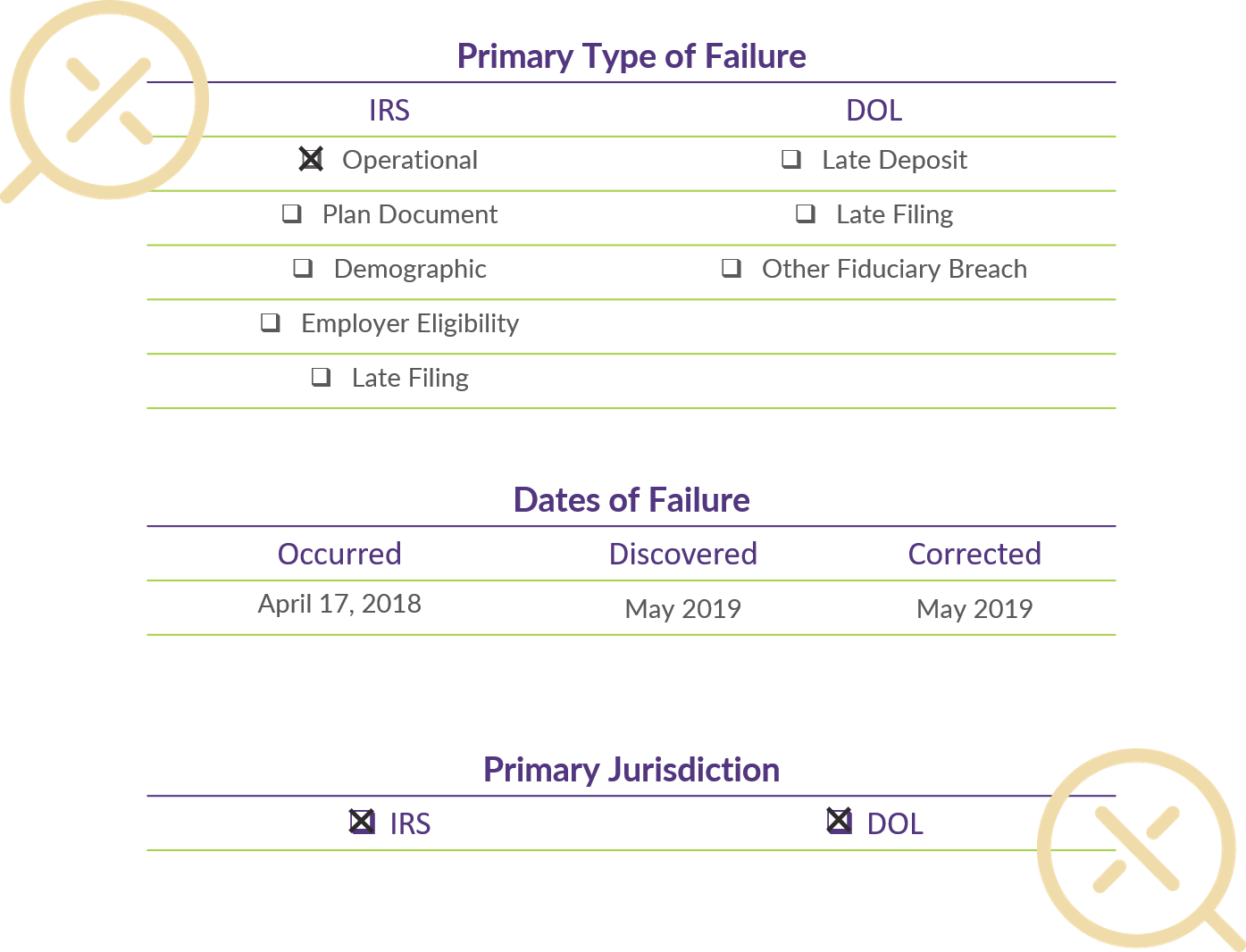

Error Details

If you’ve marched down this battlefield with us before, you know that the goal for plan corrections is to put the plan and its participants back in the position they would have been in had the error not occurred. The first crossroad this sponsor must address is whether to continue to accommodate the participant and preserve the loan. Although not the only option, our experience is that most plan sponsors prefer to preserve the loan for the benefit of the participant. We’ll assume here that WFW wants to do just that rather than trying to reverse the loan and causing difficulty for Snow. That means we’ve got a two-fold correction to work through. First, bringing the plan document back into compliance and second, getting the participant loan in good-standing. Luckily, the IRS provides specific guidance on stepping through these corrections.

Let's Start Easy

As the Waiting for Winter 401(k) Plan did not allow for participant loans at the time the loan was issued in 2018, the appropriate correction is to now retroactively amend the plan to allow for this provision. The good news is the IRS allows for this type of retroactive amendment via the Self-Correction Program (SCP) as long as the amendment satisfies certain parameters including:

- The amendment results in an increase of a plan benefit, right, or feature;

- That increase is available to all those eligible for the plan; and

- The change is otherwise permitted under the law and regulations.

In addition to the above, the basic tenants of self-correction related to significance and timing still apply. The failure must either be insignificant, or the corrective amendment must be adopted within two years of the failure. If for any reason, the amendment to the plan document would not satisfy the rules above, the amendment would require a formal application for IRS approval under the Voluntary Correction Program (VCP).

In this case, the plan adopts the retroactive amendment well within 2 years following the plan document failure and serves to expand plan features to the benefit of all eligible participants. Prompt identification of the failure and subsequent correction allows Waiting for Winter to utilize SCP to bring the plan back into compliance (with regards to this failure).

Need a refresher on the details and difference between SCP and VCP? We can help with that, click here.

Now, On to the Fun Stuff

With the plan document brought into compliance, the next issue to tackle is the participant loan failure. If the document correction seemed a little too easy, this fix will give you something a little more substantial to sink your direwolf teeth into. Participant loans by their very nature are subject to restrictions regarding amounts and terms in order to satisfy the loan rules and avoid a taxable transaction. Add to this the fact that participant loans fall into the jurisdiction of both the IRS and the DOL and navigation of full correction just got a little more interesting.

Interested in more information on the loan rules set forth by the IRS? Get the details straight from the source here.

Let's Start With the Basics

A participant loan must be amortized for level payments which must occur at least quarterly. Most plans require that payments be made via payroll deduction, so loans are typically amortized using the sponsor’s payroll schedule, e.g. bi-weekly, semi-monthly, etc. If a participant misses a payment, the loan goes into default; however, the rules allow for a cure period in which the participant may make up the missed payments to get the loan back on track. The cure period cannot exceed the end of the quarter following the quarter in which the loan payment was missed.

In Mr. Snow’s case, his first payment should have occurred in April 2018, so the cure period ended September 30, 2018. With no payments to date, Snow has missed far more than a single payment.

Like the plan document failure above, the participant loan failure may be eligible for SCP. In the case where a loan is in default due to a failure to make timely payments, the IRS provides the following correction methods:

- Lump sum payment of applicable principal and interest to bring the loan current

- Reamortization of the loan balance over the remaining period of the loan

- Combination of lump sum payment and reamortization

For Mr. Snow, this means his loan is eligible for correction by:

- Making a lump sum payment of the principal amount due for April 17, 2018 through current day plus accrued interest

- Reamortizing the $12,000 loan (plus applicable interest) over the next 4 years

- Utilizing a lump sum payment of a portion of the amount due and then reamortizing the remaining loan over the next 4 years

The IRS considers these corrections appropriate for SCP given their methodology and timeliness. For the IRS, SCP would bring the plan and loan back into compliance and avoid the loan becoming a taxable transaction for the participant.

When "Corrected" Isn't Really "Corrected"

If the above seems relatively straightforward and you’re looking for the curveball, we’ve got it for you here. Just like in the Seven Kingdoms, there is more than one party to appease in the participant loan correction process. For a participant loan to be fully corrected, the loan requires the blessings of both the IRS and the DOL. And while the IRS has set forth approved methodologies and outlined means for self-correction, the DOL does not provide or recognize self-correction for any failures. These opposing stances cause complexity and confusion when these two agencies share jurisdiction and – you guessed it – participant loans are one of those areas.

Compliance Conundrum

While the IRS considers Mr. Snow’s loan corrected, the DOL does not recognize self-correction and may very well consider the loan to still be in default. Herein lies the plan sponsor’s conundrum. From here there are two options.

Take the Risk

The plan sponsor may choose to roll the dice, utilize self-correction under IRS guidance and play audit roulette with regard to the DOL. There are a few potential outcomes should the sponsor play this game:

- The plan is never selected for audit, the loan error never discovered, and the methodology never questioned.

- The plan is selected for audit and the investigator determines the correction to be appropriate with no further actions required.

- The plan is selected for an audit, an investigator reviews the loan error and determines the correction is not complete or appropriate as it does not follow the DOL’s requirements for correction.

At this point, it’s not possible to even guesstimate the risk involved with choosing IRS self-correction and choosing not to submit the correction for DOL approval.

Play it Safe

The plan sponsor may choose the conservative approach and follow the specified guidance from the DOL. This requires the corrections as set forth above and a formal submission to the IRS Voluntary Correction Program (VCP). Although not required by the IRS, this VCP submission would serve to satisfy the DOL requirements for full correction. While it is ultimately the plan sponsor’s decision whether to take steps beyond self-correction, it is important to know the differences in the agencies’ “by the book” guidance as well as the potential risks involved with selecting an alternative correction.

Wondering about these rules? IRS guidance in Revenue Procedure 2019-19 allowed for self-correction of participant loan errors. For fun with Rev. Procs., click here.

Conclusion

If navigating the determination of various failures, the appropriate correction methods, and the requirements to satisfy the various government agencies feels like trying to keep track of the Houses of Westeros, we can assist. When an error occurs, participant loan or otherwise, identifying and correcting the error as soon as possible is the best practice. Taking steps to review the specific failure, explore related and tangential errors, and create a thorough (well-documented!) correction is key. Whether utilizing SCP or VCP for corrections, its critical to vet all potential errors and implement procedures to avoid recurrence of the error in the future.

All that said, bad things can happen to good plans. So, whether it’s preventative or prescriptive, DWC is ready to assist. For more information on our SCP and VCP services, click here.

Want to take this article with you? Click here for the printable PDF.

RELATED RESOURCES