Overtime Is Up and Bonuses Are Down: Will This Year's Irregular Compensation Impact our Retirement Plan?

Facts

We sponsor a 401(k) plan for our employees and provide a company matching contribution to those who defer. Our plan specifies that in calculating that match, we only consider employee base pay and exclude “irregular” forms of pay (specifically bonuses and overtime). This allows us to be more precise when we are building the expected cost of the match into our annual company budget.

Question

For obvious reasons, our compensation packages for employees in 2020 look a little bit different than in “normal” years. We have seen an uptick in overtime, and we are not anticipating paying bonuses at the same rate we have in the past. Are these compensation changes likely to impact our plan? Is there anything we should be preparing for now?

Answer

When it comes to excluding certain forms of compensation when calculating company contributions to the 401(k) plan, budgeting is one of the main drivers we hear. The plan design you outlined above can absolutely help with that. As a quick reminder, when a plan document is written this way, i.e. to exclude pay such as bonuses, commission, or overtime, the plan is subject to an extra nondiscrimination test referred to as the compensation ratio test.

As the name suggests, this test compares the average included compensation for the highly compensated employee group to that of the non-HCE group. And, while there’s no bright-line test for what’s considered a “passing” rate, it's generally accepted that a difference of no more than three percentage points is considered reasonable. The plan must pass this test each year that there are excluded forms of pay. That means just because a plan passes the compensation ratio test in one year does not necessarily mean it will pass in another year, especially if there are significant demographic or financial changes within the company.

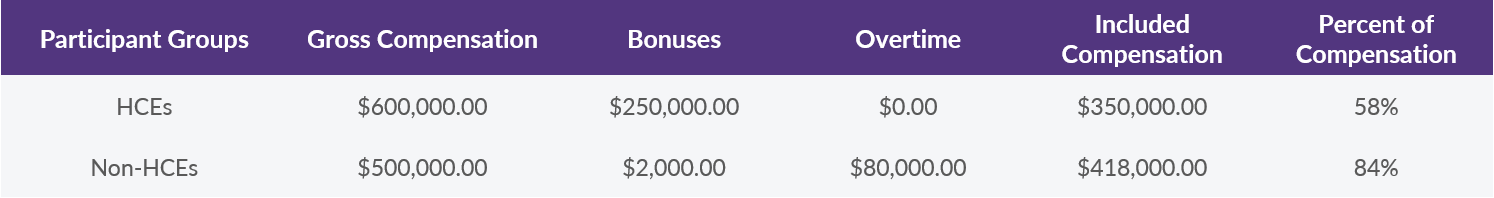

Let’s consider a quick example to address how this might play out in your situation. Assume a usual year would have your HCEs’ and NHCEs’ compensation looking something like this:

In this scenario, the HCEs are primarily receiving the bonuses, while the NHCEs primarily receive the overtime payments. The NHCEs’ percentage far exceeds that of the HCEs, so the compensation ratio test passes easily.

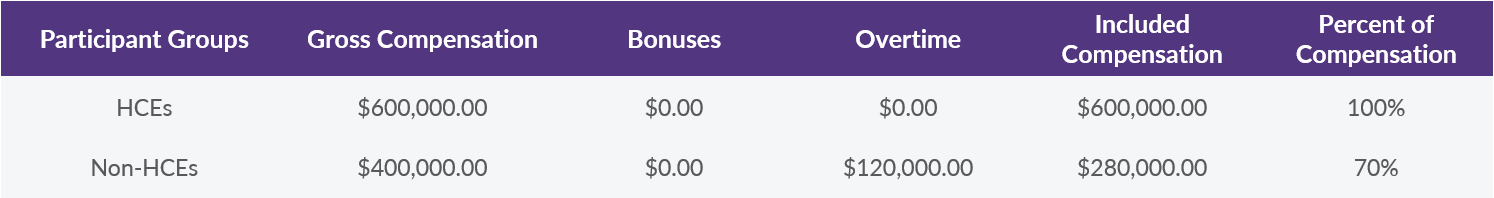

But what happens if things shift during a down year? If there’s a change in business that requires employee layoffs (or even a hiring freeze), there may a corresponding uptick in overtime to keep things running. And, in the case of a tough financial year, it’s likely that HCEs will see reduced bonuses too. Check out the chart below to see what happens to the compensation ratio test in this scenario:

Now, the average for the HCE group far surpasses the NHCE average, and the plan now fails the compensation ratio test.

Yikes! What does this all mean?

It depends on whether or not your plan is a safe harbor 401(k) plan. For non-safe-harbor plans, the path forward is a bit easier but also a bit more convoluted to explain, so please bear with us. Retirement plans can use different definitions of pay for different purposes. For example, a plan can use one definition of pay to calculate matching contributions and a different definition to perform nondiscrimination testing such as the annual ADP/ACP test.

It is this second definition that must satisfy the compensation ratio test, but importantly, plan documents usually give the flexibility to change that adjust that definition on the fly as needed. That means even though you calculate the match using base pay (because that is what your plan document says to do), you most likely have the ability to simply run your annual ADP/ACP tests using, for example, gross compensation. Assuming that passes, the problem is averted.

A safe harbor plan, on the other hand, requires the definition used to calculate the match to pass the compensation ratio test. This means there are real corrections necessary. We take a deep dive into this correction process in this correction of the quarter, but the gist is that you must amend your plan to expand the compensation that is included and then make the additional company contributions that correspond.

Don’t take this to mean that you should steer clear of an alternative definition of compensation. On the contrary, this can be a powerful tool to enhance plan design and target your retirement plan dollars according to your overall goals. As with any plan design, it’s important that you carefully consider any excluded compensation and review as compensation structures change over time. Likewise, it’s worth remembering that there is no bright-line test to determine whether a plan passes compensation ratio testing each year. So, it’s important to make sure that the definition of compensation is within reason both numerically and circumstantially. If the plan is selected for an IRS audit, you want to be confident in explaining the design and demonstrating that the definition is non-discriminatory.

Wondering how to navigate all of this or how current events may affect your plan design? Reach out to DWC and we’ll help you dig in and design, or redesign, your plan as needed!

Want a printable version of this article? Click here.