Plan Sponsor Requirements

Any company that sponsors a retirement plan for its employees has a responsibility to operate the plan properly, to follow a prudent process in making plan-related decisions (and monitoring those decisions after the fact), and to always act in the best interest of plan participants and beneficiaries. There are plenty of articles in the financial press that focus on fiduciary duties.

We cannot understate the importance of plan fiduciaries performing their duties in a prudent manner; however, in our experience, keeping up with the Tax Code’s operational requirements is far more likely to cause a compliance foot fault than the Department of Labor’s fiduciary rules. The reason is that most of the fiduciary standards are subjective in nature, focusing on terms such as “prudence” and “best interest.” Most of the Tax Code requirements, on the other hand, apply objective standards used to measure compliance.

Here are some of the plan sponsor responsibilities that we are asked about most often.

Plan Document

With all of those pages of checkboxes and legalese, it’s easy to think that close enough is good enough when it comes to following the plan document; however, neither the courts nor the IRS see it that way. Both have consistently held that the words on the plan document pages are all that matters when it comes to compliance. Any extraneous documentation about anyone’s intent is pretty much irrelevant. That’s not to say that plan provisions can never be changed. Retirement plans are generally required to be updated at least every six years, and they can be voluntarily changed at any time (subject to some timing limitations). However, once the plan document is in place, it must be followed to the letter until it is formally changed through a (mandatory or voluntary) amendment or a restatement.

It’s not enough just to have these documents, they must be timely executed (signed and dated) in order to be valid. We’ve lost count of how many times we have seen plans operated according to unsigned documents. There are some practitioners who won’t think twice about the “magic amendment” solution – coincidentally “finding” a signed document when unexpectedly facing an IRS audit. That is a dangerous game to play, and we are aware of at least one situation in which an IRS agent threatened criminal fraud charges against both the plan sponsor and the document provider over one of these magic amendments.

Government Filings

Pretty much all company-sponsored retirement plans must file certain forms with the IRS and/or the Department of Labor. Certain 403(b) plans as well as owner-only plans with less than $250,000 in assets are exempt from some, but not all of those requirements. Here are the three most ubiquitous ones:

Form 5500: Reports annual activity about a plan, including the number of participants, financial activity, and the compliance status of certain key areas. Plans must generally file no later than seven months following the end of each plan year (July 31st for calendar year plans), but that deadline can be extended by an additional 2 ½ months by filing Form 5558 by the initial deadline.

Form 5330: Accompanies remittances of certain excise taxes that are associated with qualified retirement plans.

Contribution Deposits

With all the different deadlines (depending on the reason and type of contribution), it is no wonder this topic can be cause for confusion.

Employee Deferrals The deadline to deposit an employee deferral and/or participant loan payment is generally two to seven business days following each pay date. There are certain very rare instances that allow more time (subject to an outside limit), but they are few and far between. If someone tells you that you have until the middle of the following month, get a second opinion.- Company Contributions For tax-deductibility, companies must deposit matching and profit-sharing contributions no later than the due date (including extensions) of the company tax return. However, there are some other deadlines that might apply. For example, certain safe harbor matching contributions are subject to a quarterly deposit deadline.

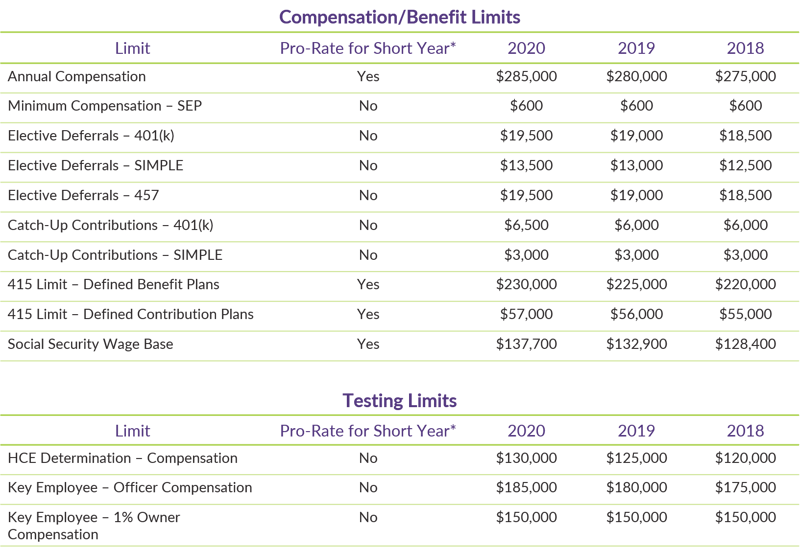

There are also specific retirement plan contribution limits that must be adhered to:

*For a plan year that is less than 12 months (either due to initially establishing the plan after the first of the year or terminating a plan before the end of the year), these limits must be pro-rated based on the number of months in the short plan year. For example, a plan year that runs from January 1st through September 30th would multiply the applicable limit by 9/12.

To see a chart of historical contribution and testing limits data, click here.

Forfeitures

Forfeitures are the amounts leftover when a former employee who is partially vested takes a distribution. Those dollars roll back into a holding account within the plan, and the plan document specifies how and when they can be used. Most plans allow forfeitures to be used for one or more of the following:

- Allocate as additional company contributions,

- Offset company contributions, and/or

- Pay eligible plan expenses.

The point of confusion is often on when forfeitures can be used. Usually, the total forfeitures for any given year will be a relatively small amount, leading some plan sponsors to decide to carry them forward for a few years until a decent amount accumulates. Unfortunately, that is generally not permitted (at least not longer than maybe a year or two). Depending on how the plan document is written, forfeitures must be used in the year they occur, in the year after they occur or a combination of the two. They cannot be carried any longer than that.

Deadlines

There are a host of other deadlines that apply to 401(k) plans. Some of them are recurring, and others are more ad hoc. The best service providers will proactively work with you to help you meet satisfy these responsibilities on a time basis. For organizations following an off calendar plan year it is important to note that these deadlines may vary from a calendar year plan.

Fidelity Bonds

Sponsors of most qualified retirement plans (including 401(k) plans, profit sharing plans, defined benefit plans, and some 403(b) plans) are also required to obtain a fidelity bond. Also known as a surety bond, this is a special type of insurance that protects a company-sponsored retirement plan from losses due to misuse or misappropriation of plan assets by a plan official. For more details on these requirements and what is actually covered, click here.

Keeping up with the nuances of the Department of Labor’s fiduciary requirements on your own isn’t easy. Build the best team of service providers for your plan to help keep you on track. Get started with our eBook, “How to Select Retirement Plan Service Providers.”

Already have a team assembled? It might be time for your own audit to ensure they are the best possible providers. We’ve broken down the questions you should be asking your advisor, recordkeeper, and TPA in these checklists. And, as always, your friends at DWC are here to answer any questions you might have.